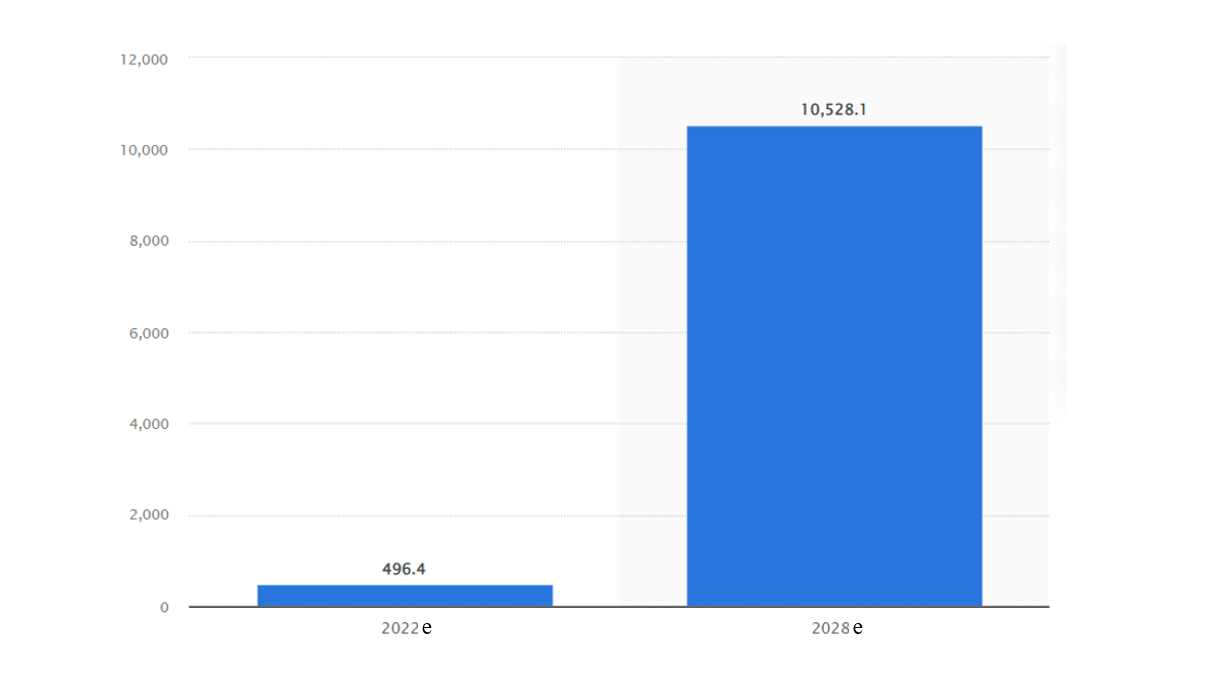

In its latest report on Vietnam’s Buy Now Pay Later (BNPL) market, Research and Markets pointed out that such payments in the country are expected to grow 57.7 per cent year-on-year to $2.28 billion this year. The market researchers also predicted that the medium to long-term growth story of the BNPL market in Vietnam remains strong. Payment adoption is expected to grow steadily, posting a compound annual growth rate (CAGR) of 31.1 per cent during the 2023-2028 period, while gross merchandise value (GMV) is to increase from $1.44 billion in 2022 to $8.82 billion by 2028.

Burgeoning access

The BNPL market in Vietnam has recorded strong growth over the last four quarters, directly related to the rise of online shopping. Vietnam is predicted to be the fastest-growing e-commerce market in Southeast Asia by 2026, with GMV reaching $56 billion, or 4.5-fold higher than in 2021, according to a report from Facebook and Bain & Company.

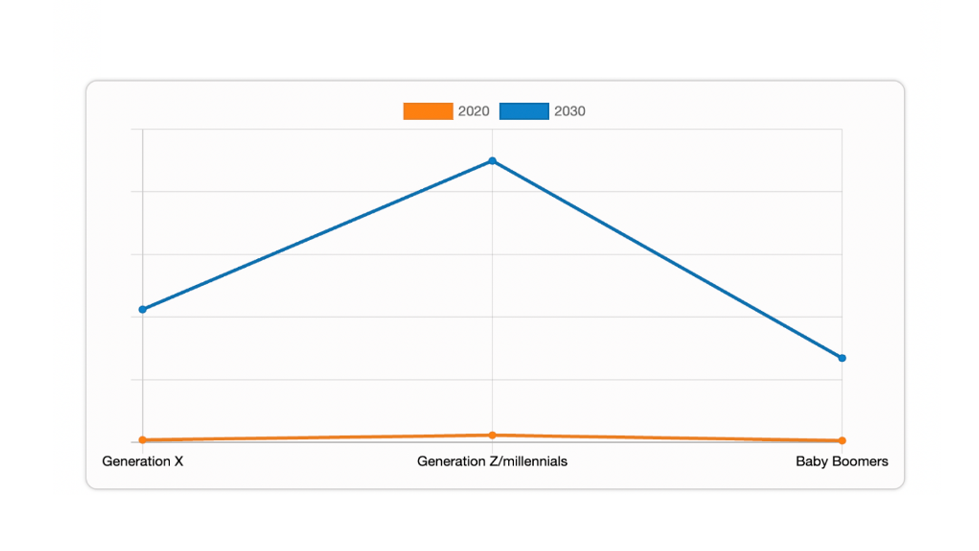

During the global pandemic, millions of new consumers turned to digital sales channels. These numbers paint a very positive picture of the country’s BNPL market over the next few years, as users will be provided with instant credit access and minimal data requirements, with transactions on e-commerce platforms and online sales sites made more convenient.

Market researchers also noted that more than half of Vietnam’s population do not use banking services and do not have access to credit, but a large part of the population are now shopping on online platforms and take part in e-commerce activities. There is huge potential for BNPL providers to offer cutting-edge solutions to a range of different customers.

In addition to major players such as Shopee and MoMo, etc., which have already been introducing BNPL services, fintechs like Fundiin, Kredivo, WowMelo, and Atome, among others, have provided BNPL payment services and seen positives results.

Fundiin, for example, achieved impressive growth in 2022, with both transaction numbers and amounts rising five-fold compared to 2021. The company has also launched two new products: “Free 30-day BNPL” and “Automatic Recurring Payment Solutions”. “The most impressive result for Fundiin is that although it chose a sustainable growth strategy, it still achieved very high growth,” said Mr. Nguyen Anh Cuong, Co-Founder and CEO of Fundiin. As a result, it was able to successfully raise $5 million in a Series A funding round at the end of last year.

Similarly, a representative from Kedivo said the BNPL market has experienced significant growth in Vietnam, both in market value and number of users. Because of that, Kredivo has had a successful year in the market, posting significant growth, expanding its customer base, and establishing itself as a key player in the industry.

Kredivo signed on with e-commerce platform Sendo last year in a deal that enabled it to access millions of Vietnamese customers while at the same time providing Sendo’s users with new funding options. “Kredivo also became the first BNPL player to partner with Moms & Kids retail giants such as KidsPlaza, to empower families in Vietnam through its smart payment solutions,” the representative said.

Mr. Cuong believes that the market’s development is not overly heated and is of good quality, because investment in the market is quite limited compared to e-wallets as a sandbox testing mechanism is still to come. “The market is of good quality because development comes from actual demand among consumers seeking smarter payment solutions and more convenience, and there is rising demand among retailers looking for utilities and solutions to retain customers,” he said.

Issues to address

With an emerging market like Vietnam, potential always comes with problems and BNPL is no exception. iDEA believes that the common challenge for e-commerce is also the challenge that the BNPL market faces. The cash-on-delivery (COD) payment rate is still high, estimated at 73 per cent of all payments, with the remaining 27 per cent being people on stable incomes and with bank accounts and credit cards. They therefore already have the ability to pay for items immediately, and simply don’t need BNPL services.

Though many people in Vietnam know about BNPL, many don’t fully understand the concept. “BNPL has been introduced in Vietnam only recently and the method remains unfamiliar to many,” the Kedivo representative said.

The instability in the capital market in Vietnam and around the world has also led to obstacles in the BNPL market in general and for providers in particular. “Instability in the macro-economic situation, such as falling incomes, rising risks, increasing capital costs, and frozen capital markets, will be among the difficulties Fundiin will face in the future,” said Mr. Cuong. “It has faced many difficulties without the Sandbox mechanism.”

Preparing for success

Nonetheless, the market potential remains significant and allows providers to further their operations and develop. “2023 is expected to be a year of much instability, but will also be a year of great opportunities for BNPL providers and a foundation year for the BNPL market in Vietnam,” Mr. Cuong believes.

Given that major players in many fields, both online and offline, will begin to implement BNPL, Fundiin’s plan remains to grow quickly but with caution, so it can take advantage of opportunities while being ready to change if the macro situation warrants it. “Fundiin will soon launch new BNPL solutions with longer terms to better meet customer needs,” Mr. Cuong said.

As the primary objective of BNPL providers is to deliver the best user experience, Kredivo has persistently tackled the challenges since entering Vietnam and will continue to pursue its strategies into the future. “BNPL is also a new concept for many merchants, and we must raise awareness,” the Kredivo representative said.

In 2023, it aims to reaffirm its position as one of the market leaders both regionally and in Vietnam and will continue to focus on two key matters: enhancing the customer experience and expanding its merchant network. “Customer-centricity is Kredivo’s direction in all operations,” the Kredivo representative said. “We will continue to innovate by releasing new product features and making product improvements to meet the evolving demands of Vietnamese customers, and add more functions to make the experience more seamless and customer lives easier and more convenient.” she added.

It will also continue to expand its network of trusted merchants across diverse industries, enabling them to reach consumers effortlessly while providing users with a seamless shopping experience and smart financial options. “BNPL will also help local merchants boost their sales and increase customer loyalty when shopping online,” the representative said. “I believe that BNPL will continue to grow both in number of providers and the quality of services, to meet the growing demand among local consumers and the business community.”

Google translate

Google translate