Starting July 1, a major shift has been taking place in Vietnam’s life insurance market. Life insurers are officially pulling the plug on new sales of investment-linked products and add-on benefits that fail to comply with Decree No. 46/2023/ND-CP dated July 1, 2023, on the Law on Insurance Business. Under Article 102 of the Decree, investment-linked policies are now only allowed to cover two core risks: death and total permanent disability. Any additional protections, such as accident coverage, critical illness, or hospitalization, must be offered through standalone riders.

Though the regulation took effect back in July 2023, insurers were given a two-year transition window. With the final deadline now passed, those that haven’t adapted must cease offering non-compliant insurance products. Anticipating this, many life insurers started rolling out new universal life products as early as June. The changes are expected to set the stage for more sustainable and responsible growth in Vietnam’s life insurance sector over the medium and long term.

Life insurance hits reset

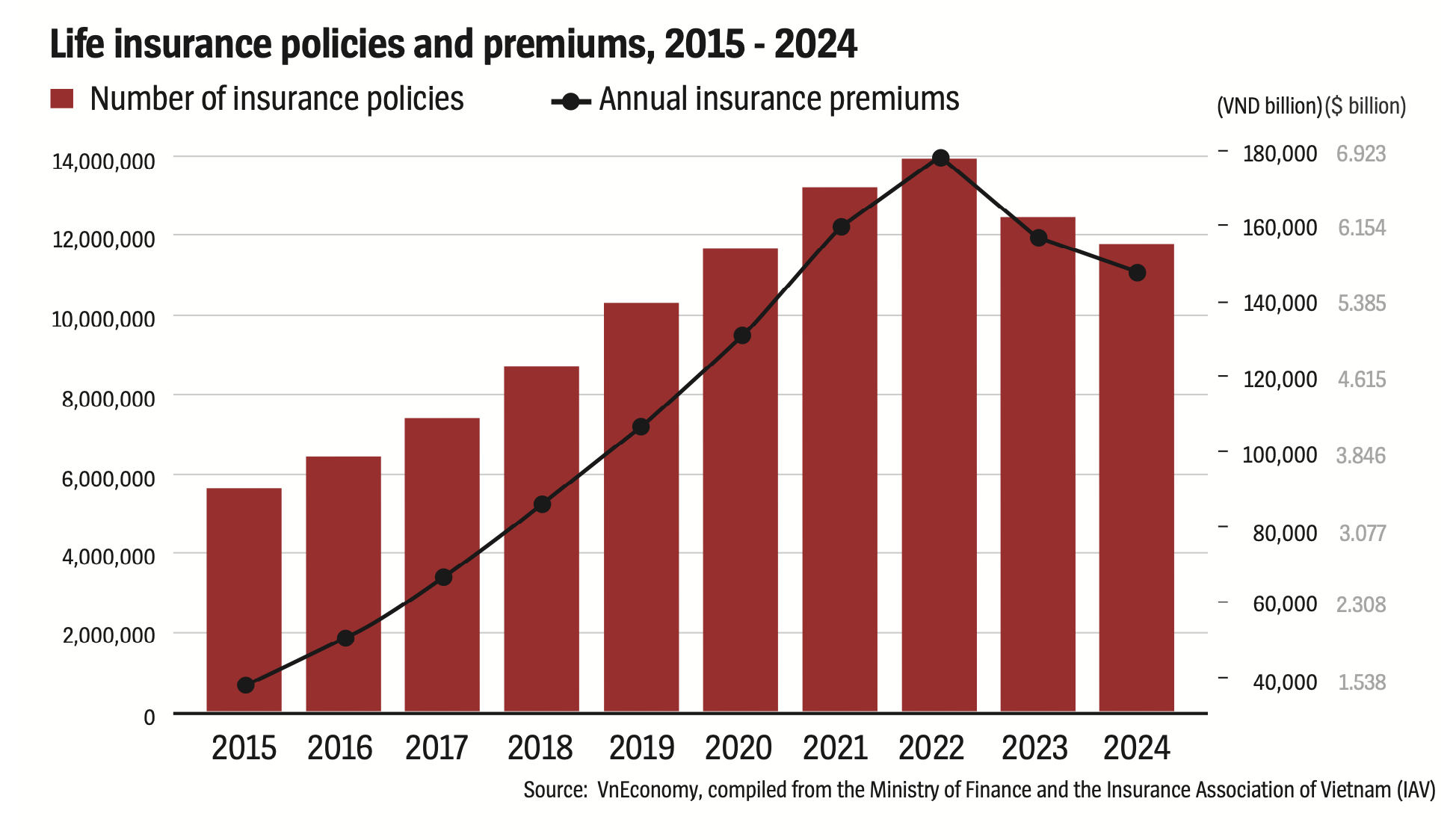

From 2015 to 2021, Vietnam’s life insurance market enjoyed strong, steady growth. Premiums climbed at an average rate of over 30 per cent a year from 2016 to 2018 and stayed above 20 per cent in the years that followed. At the same time, the number of policies rose 14-18 per cent each year, reflecting both rapid market expansion and deeper consumer adoption.

Growth began to slow, however, in 2022. Though premiums still rose, the pace fell sharply, to 11.9 per cent, and the number of new policies grew just 5.5 per cent. The downturn became more pronounced in 2023 and 2024, with premiums falling 11.9 per cent and 5.7 per cent during the two years while policy numbers were down 10.7 per cent and 5.2 per cent year-on-year.

This sudden shift after years of continuous expansion highlights the impact of the ongoing economic headwinds, both local and global, which have changed consumer behavior, and a loss of trust following controversies over investment-linked products and bancassurance mis-selling. Regulators responded to this by tightening rules on investment‑linked contracts under Decree No. 46.

According to Mr. Ngo Trung Dung, Deputy Secretary General of the Insurance Association of Vietnam (IAV), in the first quarter of this year six out of every ten new life insurance policies were universal life products. Customers aged 30 to 50 still value savings and accumulation, but now prioritize guaranteed interest, product simplicity, and transparency over chasing high returns.

Ms. Huong Lan, 29, from Long Bien ward in Hanoi’s Gia Lam district, has been researching insurance ahead of her wedding later this year and anticipated family thereafter. She sought a policy with a minimum guaranteed interest rate, a high sum assured relative to the premium, and clear terms, with an insurer known for transparent claim payments.

From an industry perspective, Mr. Luong The Vinh, Head of Product at Prudential Vietnam, said customers now expect solid protection, attractive premiums, and sustainable accumulation. Above all, they want flexibility to adjust benefits and premiums as their needs evolve.

Since June, major insurers have announced they will end selling certain products and have overhauled their portfolios. New offerings designed to meet Decree No. 46 allow customers to tailor their benefits, adjust their premiums, make partial withdrawals, or change beneficiaries. Core coverage and supplementary riders are clearly separated.

Policies approved before July 1, remain valid, with all agreed benefits remaining. Any applications not fully underwritten by the deadline will be cancelled and paid-in premiums refunded.

Setting the stage

In a recently-published report assessing the outlook for Vietnam’s life insurance market, UK-based analytics firm GlobalData forecast that the country’s total gross written premiums (GWP) will reach $6 billion in 2025; a slight decline of 1.3 per cent compared to the estimated $6.1 billion in 2024.

Despite this dip, the market is expected to begin recovering from 2026. GlobalData projects that the life insurance sector will achieve a compound annual growth rate (CAGR) of 3.2 per cent between 2025 and 2029, with the market size reaching around VND165.4 trillion ($6.62 billion), equivalent to $6.4 billion, by the end of the period.

According to Mr. Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, the recovery will be driven by a combination of stricter regulatory frameworks, evolving demographic trends, and a renewed focus on restoring public trust. Vietnam’s life insurance penetration currently stands at only 1.3 per cent of GDP, far below regional benchmarks such as Thailand (3.5 per cent) and Taiwan (8.7 per cent), highlighting considerable room for growth. In addition, the adoption of emerging technologies like AI, big data analytics, and digital platforms is expected to enhance the customer experience and service quality, accelerating the industry’s transformation.

Mr. Sahoo emphasized that Vietnam’s life insurance market holds promising long-term prospects, supported by a strengthened legal framework, growing digital capabilities, and product strategies increasingly aligned with customer demand. Rising healthcare costs and a rapidly-aging population will also continue to shape a more resilient and sustainable market in the years ahead.

Adding to this positive outlook, Mr. Dung highlighted a notable reform in the revised Law on Insurance Business: an expanded definition of “insurable interest”. Previously limited to immediate family and dependents, the Law now allows coverage of individuals with financial or employment relationships with the insured. This change reflects the realities of a more interconnected economy, where banks can insure borrowers and companies can insure employees due to legitimate financial stakes in their well-being and productivity.

Another important reform allows any individual to purchase a life or health insurance policy for someone else, as long as the insured party provides written consent. This change overcomes previous legal restrictions that limited such transactions to family members or legal guardians, and make it possible for acts of goodwill to be legally recognized. For instance, individuals or charitable organizations can now offer insurance to those in vulnerable situations, such as children or the homeless, creating new avenues for meaningful and sustainable philanthropy.

In addition, under the new regulation, insurance contracts remain valid even if the insurable relationship no longer exists at the time of a claim. As long as the relationship was valid when the contract was signed, it will remain enforceable. This addresses common legal challenges, especially in cases involving divorced spouses or family members no longer living together, and helps minimize disputes while safeguarding the rights of both the policyholder and the insured.

Industry experts agree that these progressive legal reforms will play a vital role in revitalizing Vietnam’s life insurance sector and laying the foundation for long-term development grounded in transparency, flexibility, and customer trust.

Google translate

Google translate