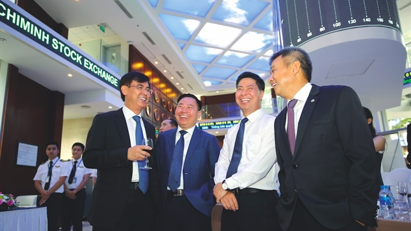

Stock market posts record decline

The fall of 276 points during September has resulted in a decline in the VN-Index of 500 points since the beginning of the year; one of the largest in the world. Not only domestic individual investors lost and withdrew funds, with many foreign funds also reporting record losses.