Midmarket companies are the backbone of Vietnam’s economy. These energized, medium-sized enterprises drive innovation, create jobs, and keep the country competitive in exports. Yet many are leaving value on the table.

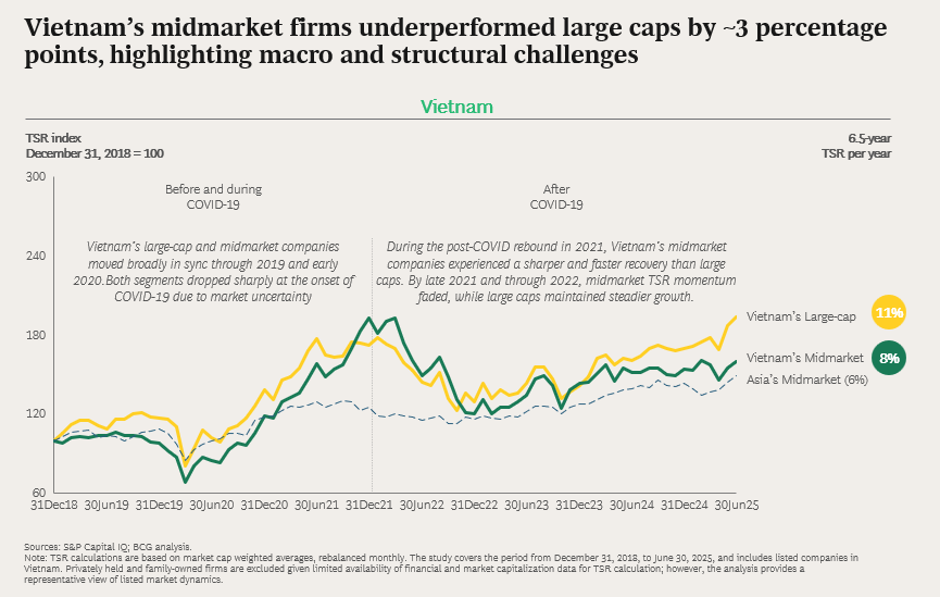

Boston Consulting Group’s (BCG) latest analysis highlights a telling performance gap. Total shareholder return (TSR) for Vietnam’s midmarket has grown at approximately 8 per cent per year, in contrast to the 11 per cent annual growth of large-cap companies.

This gap is narrower than in many other global markets, with a six-percentage-point gap between midcaps and large caps in North America, and seven percentage points in the Asia region.

Navigating macroeconomic headwinds

The macroeconomic environment presents unique challenges for Vietnam.

Financing structures remain conservative, with midmarket companies predominantly relying on traditional bank debt or retained earnings rather than capital markets. The domestic investor base is less mature than many regional peers, constraining market depth and liquidity.

Operational frictions also weigh on midmarket margins. Fluctuating foreign exchange rates introduce unpredictability, with FX volatility compressing midmarket margins faster than those of large caps. High logistics costs and uneven infrastructure further complicate supply chains. These aren’t just budget constraints; they are barriers to scale.

Finally, Vietnamese businesses continue to struggle with a digital lag. Innovation requires investment, and many midmarket players have been slow to adopt the digital tools that drive efficiency. Digital skill levels in Vietnam are also less advanced than those of comparator companies.

These challenges have been underpinned by a turbulent growth history over the last decade, with sharp swings post-2021 and a slower recovery during the post-pandemic correction. This reflects limited buffers against disruption and exposure to punishing macro headwinds.

The global structural squeeze on midmarket companies

Vietnamese midmarket firms are not alone. BCG’s latest global report, Seizing the $3 Trillion Midmarket Opportunity, highlights three key challenges that heighten exposure to macro shocks.

Midmarket firms struggle to attract and retain top-tier talent. Our data shows annual employee attrition at midmarket companies sits at 9 per cent, compared to 7 per cent at large caps. Worse, a clear skills gap is emerging. While large caps aggressively recruit for AI, software engineering, and data analytics roles, midmarket firms are still hiring primarily for operational and service-based roles. This leaves them ill-equipped for a digital future - a gap that only intensifies as the AI race further separates leaders and laggards.

Access to capital is also more expensive and restrictive for the midmarket. These firms carry higher debt-to-equity ratios (averaging 1.5x to 1.6x compared to 1.3x for large caps) and have greater exposure to variable-rate debt. Only 35 per cent of midmarket companies receive investment-grade ratings, compared to 85 per cent of large caps. This makes borrowing costly and limits their ability to fund long-term transformations.

Subscale operations also lead to inevitable cost disadvantages. Midmarket companies consistently face cost ratios that are three to five percentage points higher than large caps. They lack the purchasing power to negotiate better terms with suppliers, leaving them with thinner cushions to absorb inflation or supply shocks.

Four critical steps to close the gap

These challenges are not insurmountable. BCG has identified four critical steps to break the midmarket lag and energize these valuable enterprises.

Step 1: Start with a big vision and fund it.

Incremental changes yield incremental results. Midmarket leaders need to set a bold ambition to unlock the full potential of the business. This prevents the “value leakage” that often causes transformations to fall short.

However, ambition requires funding. Leaders must fully reset the cost base to free up capital, using zero-based budgeting (ZBB) for every process. This enables midmarket companies to stretch targets and prevent unnecessary costs from creeping back in. The goal is to cut smart, then grow. This allows the firm to power long-term bets, investing in strategic capabilities like AI and digital talent that build a lasting advantage.

Step 2: Hardwire commitment, starting with the CEO.

Transformation must be the CEO’s top agenda item. The CEO should be visibly focused on the change, signaling its importance to the entire organization.

This commitment must extend to the leadership team. The CEO needs to bring the team together behind a shared agenda, ensuring everyone is pulling in the same direction. To make this stick, companies should hardwire incentives. Compensation and bonuses, from the C-suite down to the front line, must be tied directly to transformation objectives.

Step 3: Make tough choices and drive execution.

Speed matters more than scale. Midmarket firms have the advantage of agility. Leaders should leverage this by moving quickly to gain momentum.

This requires ruthless prioritization. You cannot do everything at once. Make critical investment trade-offs and allocate your best talent to the most important initiatives. Adopt an execution approach built on agility. Break work into sprints (e.g., 90-day cycles) to deliver value early and often. Crucially, the CEO must lead from the top. Not every decision requires consensus. In times of change, clarity and decisive leadership trump endless deliberation.

Step 4: Lead the change and communicate regularly.

The cultural side of transformation is often the hardest, but most vital element. Leaders must leverage their company’s manageable size to drive faster behavior change. This starts with regular, clear, and consistent communication.

Be direct about what is changing, why it is changing, and what it means for teams. Establish feedback loops that allow the organization to listen, adapt, and reinforce key messages. To scale this effort, appoint “change champions” throughout the business to model new behaviors for their peers.

Finally, identify top talent and implement specific retention plans. Given the high attrition rates among leading talent, keeping your best people motivated and energized is nonnegotiable.

Seizing future opportunity for Vietnam’s midmarket

Strengthening Vietnam’s midmarket is more than a corporate goal; it is a strategic national opportunity. By addressing these structural barriers, midmarket firms can unlock the next wave of growth, resilience, and competitiveness.

The gap between midmarket and large-cap performance is real, but it is not permanent. With bold vision, disciplined execution, and decisive leadership, Vietnam’s midmarket champions can position themselves as the energized, agile drivers of the economy.

Google translate

Google translate