Vietnam boasts a well-earned reputation for high growth and resilience over the decades in the face of global economic and geopolitical crises. Supported by a strong economy and robust market, the rate of Vietnam’s personal financial assets (PFA) growth has outpaced that of other Asian countries in the past ten years. PFA has multiplied significantly and, along with it, a high demand for wealth management focused on needs-based financial advisory catering to retail customers has arisen.

Exponential growth

Vietnam’s financial markets have developed significantly in recent years with the support of more liberal financial market regulations and rising customer demand for wealth management. In the past decade, Vietnamese regulators have recognized the growing demand for investment opportunities and have taken significant steps to provide customers with easy access to investment solutions. This trend is expected to accelerate as the Vietnamese Government implements financial development plans through 2030. Its focus will likely be on financial market regulation, such as ensuring that outstanding debt in Vietnam’s bond market accounts for approximately 65 per cent of GDP.

Since 1990, Vietnam has been on an innovation spree, with a series of initiatives and policies to boost the development of capital markets. These innovations, which included the introduction of government bonds in 1990, the opening of the Ho Chi Minh Stock Exchange in 2000, and the establishment of Vietnam’s first securities company in the same year, facilitated the country’s transition into a regional force with increasing international influence.

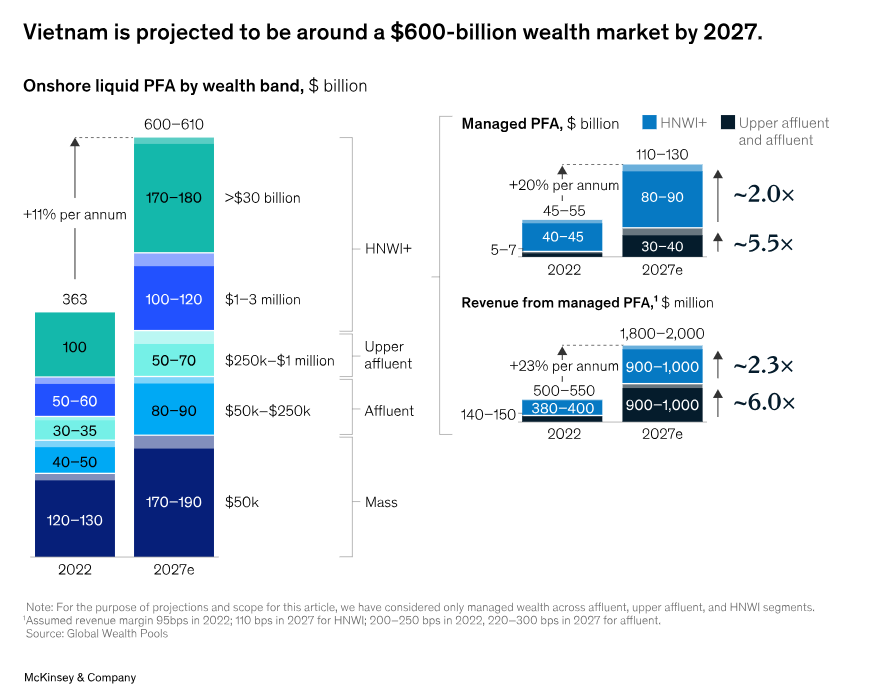

By 2027, Vietnam is projected to be a roughly $600-billion PFA market, growing at a rate of 11 per cent per annum from a baseline PFA of about $360 billion as of year-end 2022.

The share of managed wealth assets as part of overall PFA is expected to increase, but with a varying starting base across customer segments. Affluent segments will rise by around 5.5-fold by 2027 and high-net-worth-individuals (HNWI) by about double in the same period. This will translate into an estimated additional $65 billion to $75 billion of managed wealth assets in the industry for institutions to capture. The associated revenue pools for managed assets are projected to have equal contribution across the affluent and HNWI segments. Firms, therefore, stand to benefit from the untapped wealth opportunity by focusing on capturing the growing affluence and money in motion from cash and deposits to wealth solutions, like investment and insurance.

Increasing competition

Recognizing the space in the market and the tremendous opportunity that could come from around $600 billion of wealth pools by 2027, various institutions, both financial and non-financial, are ramping up capabilities to augment existing business and launch new wealth management propositions. These will be focused on customer segments across the wealth continuum (mass, affluent, and HNWI customers).

Firms can be categorized into four broad types: local commercial banks, global or regional banks with a local presence, independent portfolio management companies, and insurers. In addition, wealth fintechs are fast emerging but are still in their nascent stages. These types will potentially change with the further acceleration of wealth management growth in the industry. Here, however, we focus solely on banks and insurers, drawing on information obtained from our extensive work and research within the banking and insurance industries.

Banks

Banks have been quick to move into this space by leveraging their large captive customer base and distribution network to offer solutions across the wealth continuum. They have been building in-house investment capabilities while leveraging access to investment subsidiaries, like securities and fund management companies, within the same group. Some banks are also exploring international partnerships with foreign banks, thereby gaining global expertise to enhance their wealth management capabilities across the product dimensions and global standards of risk management capabilities.

As the current competitive landscape stands today in Vietnam, local commercial banks are emerging as winners. However, their solutions and offerings are in nascent stages as they are still experimenting with operating models. Global banks with a presence in Vietnam are fast catching up to capture the country’s wealth-management opportunity, while building on their robust technology capabilities to offer digital wealth solutions enabled by multi-channel engagement models and cross-corridor connections in the region.

Insurers

There is huge potential for insurers to foray into the wealth management space. They are beginning to realize the opportunity by defining their right of play and right to win in this arena. They have been expanding their financial advisory offers, but are restricted to insurance products. Their big opportunity, therefore, is to offer integrated insurance and investment solutions to customers as part of holistic wealth solutions.

Although the competitive intensity is increasing in Vietnam, the wealth management space is still underpenetrated and untapped compared to peer countries in the region.

As part of multichannel engagement and an exclusive portfolio of value-added services, customers have specific requirements for real estate advisory within the broader solutions suite, such as exclusive and dedicated physical spaces (for example, exclusive private banking lounges for HNWI customers). As institutions begin to define their propositions, it is critical to consider local nuances as part of overall financial advisory offerings across the wealth continuum.

Wealth management trailing demand

Despite the great potential in this sector, it remains disproportionately undeveloped and barely keeps up with demand. Challenges stemming from within and beyond the financial services industry keep the wealth management sector stunted. To better comprehend this, we carried out considerable research across the wealth continuum in Vietnam, particularly within the affluent and HNWI customer segments. The research identified challenges that confront customers and financial institutions that might account for the slow growth in the Vietnamese wealth management sector.

We undertook extensive interviews with affluent and HNWI customers, spanning specific customer personas: high-income professionals, entrepreneurs, business owners, self-employed, and retirees. These interviews uncovered four pain points: a lack of trust in financial institutions, wealth management products lacking depth and breadth, customer needs not being met by relationship managers, and limited multichannel engagement.

We also spoke to financial institutions and observed four structural unlocks: dilutive onshore regulations, restrictive offshore regulations, talent gaps, and underdeveloped digital infrastructure.

While these structural shortcomings are challenging, solving them can allow financial institutions - banks, insurers, securities firms, and wealth-related fintechs - to prioritize wealth management and benefit from the huge market opportunity that exists in this sector.

Capturing value

To seize the promising opportunity across the wealth continuum, financial service providers need to choose specific operating models to serve affluent and HNWI customers. The sequencing of business build will depend on the starting base and existing capabilities, but it is critical to look through an overall wealth-continuum lens to engage with customers across the lifecycle stages and events within one integrated platform.

The segments across the wealth continuum are closely related but fundamentally very different in terms of needs and behavior, an important distinction of which institutions need to be aware. Through our extensive work across the financial services space, we see that from a financial institution’s perspective, there is a clear differentiation in developing capabilities for these two segments in terms of the operating model and the associated cost to serve customers (acquisition and engagement).

Pursuing HNWI customers

Through our research on the wealth management business build across the globe, including in Vietnam, we have identified eight key building blocks that could help banks build, scale up, and differentiate their private banking businesses.

Firstly, having an in-house data and analytics-driven capability to understand the existing customer base is a key cornerstone. Secondly, we have observed that customers in Vietnam demand bespoke solutions, as they believe the breadth and depth of existing offerings are restricted. Thirdly, it is critical for institutions to define customer acquisition channels, given the sophisticated business model for scaling up the private banking business. Fourthly, there is a need for a seamless service model. Fifthly, firms need to establish a rigorous and institutionalized advisory framework.

Sixthly, based on our research, we have noticed that banks in Vietnam are broadly behind the curve in terms of digital support infrastructure for relationship managers to advise customers. A fully loaded digital workbench, with the integrated insurance and investment customer journey(s), is essential for a scalable and sustainable franchise. Seventhly, one of the big challenges in Vietnam’s wealth management market is the limited talent pool for building a private banking business, and this arises again and again in our conversations with industry players. Banks need to be very focused with their talent strategies to find the correct talent, while constantly addressing upskilling and retention of incumbent staff. Eighthly, banks also need to be pragmatic on what can be done within the existing ecosystem and what needs to be extended beyond to third-party partnerships for a quick scale up. A targeted set of partnerships across three core themes could work well.

Vietnam has an enviable opportunity to amplify the impact of its wealth management sector in light of the country’s resilient economic growth and expanding consumer base. A very effective way of developing the wealth continuum is to know customers deeply and accurately, thereby devising and applying precise and efficacious operating models. Understanding customers’ nuances is paramount, including seeing the subtle but important differences between the affluent and HNWI segments. Financial institutions need to develop an obsession with customer requirements to build a highly customer-centric business across Vietnam’s wealth continuum.

* Bruce Delteil is a partner in McKinsey’s Hanoi office, Arsh Khosla is a consultant; and Vishal Kaushik is an associate partner in the Singapore office.

Google translate

Google translate