Ninja Van is now in the process of focusing on improving operations over the closing months of the year to deliver goods during the peak Christmas and New Year period. It is also focusing on strengthening the spirit of its human resources to develop a sustainable companion strategy with partners. “Vietnam has the most advantages in Southeast Asia in developing express delivery services,” said Mr. Phan Xuan Dung, Sales Director at Ninja Van Vietnam.

Market of promise

J&T Express Vietnam opened a Sorting Center in Cu Chi district in Ho Chi Minh City in the middle of this year, with some 60,000 sq m fitted out with smart logistics systems in processing, storage, and delivery. With its new center and upgraded technology, J&T Express Vietnam’s daily processing capacity increased four-fold year-on-year in the first half of the year, with sorting accuracy at over 99 per cent.

It also introduced payments via QR codes to improve convenience and safety for users and businesses. “Vietnam’s logistics industry in general and the express delivery service market in particular have great potential for development,” said a representative from J&T Express Vietnam. “The shopping demand of Vietnamese users is also an important factor in promoting the development of the express delivery service market.”

With a goal of reaching a revenue target of more than VND133 trillion ($5.33 billion) by 2030, along with building postal infrastructure and developing services for e-commerce and logistics, Vietnam Post has been implementing plans to open, consolidate, and modernize regional transportation centers and modern infrastructure to meet needs in goods transportation and trade between cities and provinces around Vietnam.

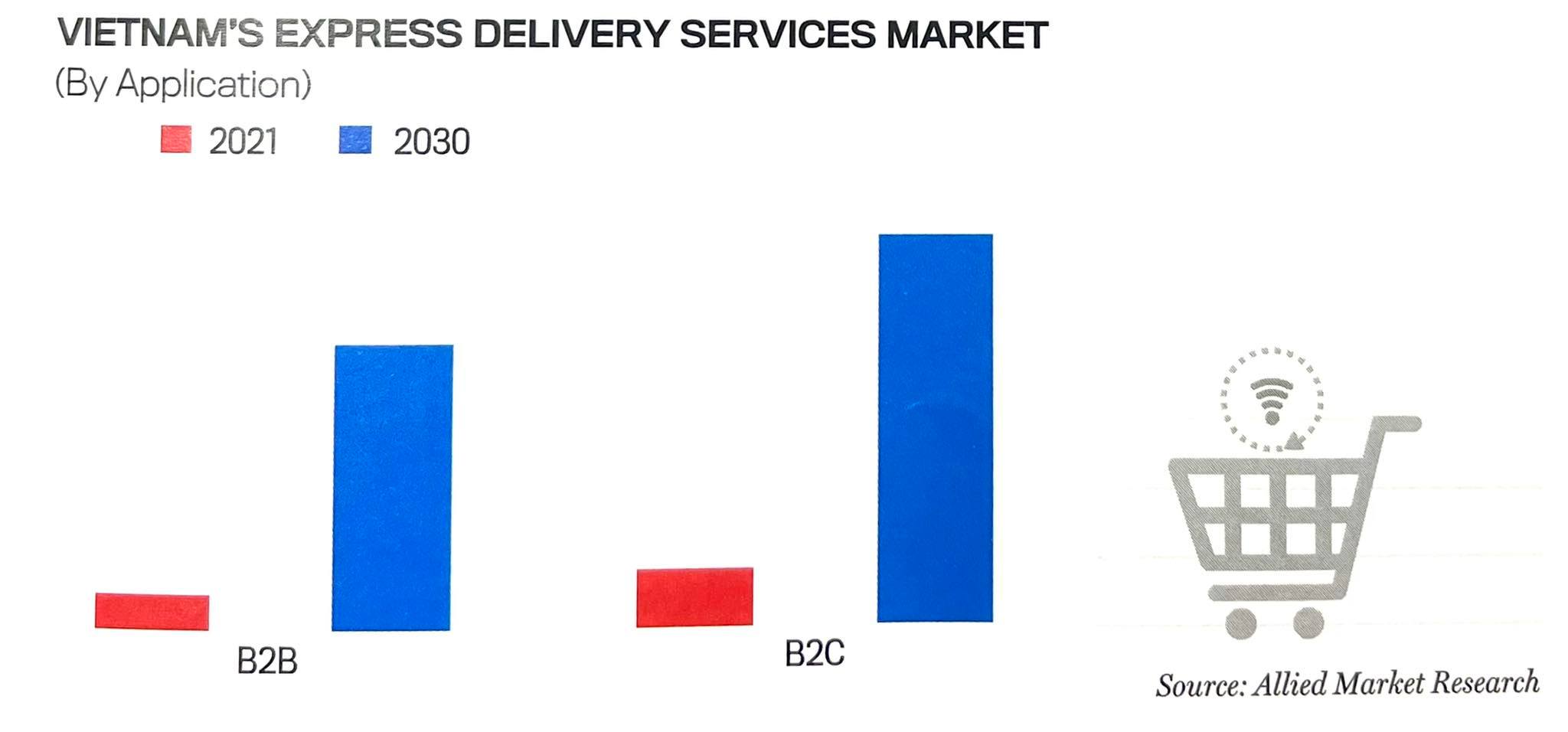

A report released by Allied Market Research showts that Vietnam’s express delivery service market was worth $710 million in 2021 and is forecast at $4.88 billion by 2030, with a compound annual growth rate (CAGR) of 24.1 per cent in the 2022-2030 period. The report noted that the key players are GHN (Fast Delivery), BEST Express Vietnam (BEST Inc.), GHTK, J&T Express (Vietnam), Nin Sing Logistics Company Limited (Ninja Van), Swift247, Viettel Post, and VNPost.

“Along with the development of the e-commerce market, the shopping demand of Vietnamese users has increased sharply, leading to a rapid increase in the number of goods shipped, so the role of express delivery services is now more important,” the J&T Express representative noted. The number of online shoppers in the country is expected to reach about 55 per cent of the population by 2025, with average annual spending of $600.

Similarly, Mr. Dung emphasized that Vietnam has a high rate of shoppers, diverse e-commerce products, and consumer acceptance of products originating from many different countries. “The proportion of young people in the population is high, with advantages in terms of absorbing modern technology, optimizing production and costs,” he went on. “The habit of shopping online will become a lifestyle and drive the express delivery market.”

Maintaining progress

Players in the market, however, still face infrastructure difficulties, which are seen as a major challenge for the entire express delivery industry. For online sellers, rapid delivery is a major factor in customer satisfaction, but Vietnam’s traffic infrastructure means speed cannot be guaranteed.

“Congestion is common, along both inner-city routes and inter-provincial routes, making it difficult for express delivery providers to make deliveries,” the J&T Express representative said. “Existing infrastructure problems cannot be fixed immediately, so players are forced to find ways to optimize order processing times as much as possible.”

Gasoline prices, meanwhile, are forecast to increase again, which may affect freight costs and driver psychology. “In order to overcome such a situation, Ninja Van has introduced many policies to encourage our drivers,” Mr. Dung said. It also offers promotions and proposes an optimal delivery plan in terms of price and time in order to find the right model and selling power of each vendor, helping them focus on their business with peace of mind.

Players also have their own plans to promote services to not only contribute to the growth of the market but also meet growing customer needs. “J&T will continue to invest in upgrading and expanding network infrastructure while applying development technologies towards digital businesses,” the representative said. “In the fourth quarter, we will also cooperate with Zalo to deploy the Zalo Notification Service (ZNS), a customer care message service via an application programming interface (API) system, to increase proactivity in checking and controlling orders and boost convenience for users.”

“With rapid economic recovery post-pandemic, Vietnam is attracting foreign businesses investing in expanding and improving business performance,” said Mr. Dung. “Players in the express delivery services market in Vietnam also see this potential, so they are adopting strategies to focus on improving services and enhance customer loyalty.”

Google translate

Google translate