Addressing the “Developing the Corporate Bond Market by 2030: A Perspective from Credit Ratings” seminar, jointly organized by Vietnam Economic Times (VET) / VnEconomy / Tap chi Kinh te Viet Nam, Moody’s Ratings, and VIS Rating in May this year, Mr. Jeffrey Lee, Regional Manager of Sustainable Finance for the Asia-Pacific region at Moody’s, highlighted several key points in the development of green bonds and the sustainable finance market in various Asian countries, including Vietnam. He emphasized the increasing importance of sustainable financial practices and the growing trend towards green bond issuances in the region, driven by a host of initiatives and support policies.

Sustainability classification

Amid global trends towards sustainable development, the classification of green and sustainable finance has become an increasingly important component of financial policies for governments and financial institutions across Asia. This shift is reflective of a broader commitment to integrating environmental, social, governance (ESG) criteria into financial decision-making processes to promote long-term economic resilience and ecological stewardship. Countries such as South Korea, China, Malaysia, and Indonesia have initiated the adoption of sustainable classification principles, aiming to standardize and promote investments that contribute to sustainability goals.

Notably, Thailand and Singapore have made significant strides forward by completing their sustainable finance classification systems, setting benchmarks for other nations in the region. Australia is also actively developing its own version of a sustainable classification framework, demonstrating a commitment to align its financial sector with global sustainability standards. Vietnam, meanwhile, is participating in the regional movement, introducing several initiatives designed to integrate sustainability into its financial practices and enhance its appeal among international investors seeking sustainable investment opportunities. This collective effort in Asia-Pacific countries underscores the region’s proactive approach in supporting the global agenda for sustainable development and highlights a transformative period in the integration of sustainability within financial systems.

“These governments are working hard to provide guidance for issuers, businesses, and investors on sustainable classification to promote sustainable financial markets,” Mr. Lee told seminar participants. “And these supportive policies have created a favorable environment for sustainable development in the region.”

One noteworthy illustration of sustainable classification can be found in Singapore, which has evolved into a thriving hub for sustainable finance. With a focus on achieving significant milestones, the island state has dedicated efforts to developing robust classification systems aimed at standardizing the market. A recent milestone along this journey was the completion of the Singapore-Asia Taxonomy, a comprehensive tool designed not only to pinpoint key assets but also transitional assets, thus providing a nuanced understanding of sustainable investment opportunities in the region.

In Japan, though a specific green classification system has not been established as yet, a different approach is being taken by providing detailed roadmaps for each sector. These roadmaps guide the type of assets to invest in across eight different sectors, flexibly and creatively promoting sustainable development.

Boom in green financial support

Green and sustainable financial support programs are thriving throughout Asia, to offset the high administrative costs associated with issuing green bonds compared to regular bonds, including consulting and independent evaluation fees from organizations like Moody’s Ratings. Green bond support programs are being implemented in Japan, Hong Kong (China), China, and Singapore, offering incentives that make it easier for businesses to access sustainable financing. “These initiatives have helped ease financial barriers and promote the development of sustainable financial markets,” Mr. Lee added.

In addition to green financial support programs, many countries in Asia also provide subsidies for ESG skills training. Disclosing ESG factors has become essential within the sustainable finance market, but the lack of data presents challenges for investors and ratings agencies like Moody’s.

In Singapore, Hong Kong (China), and Japan, ESG disclosure is now a mandatory requirement when listing on the stock exchange, in a bid to help develop sustainable financial markets.

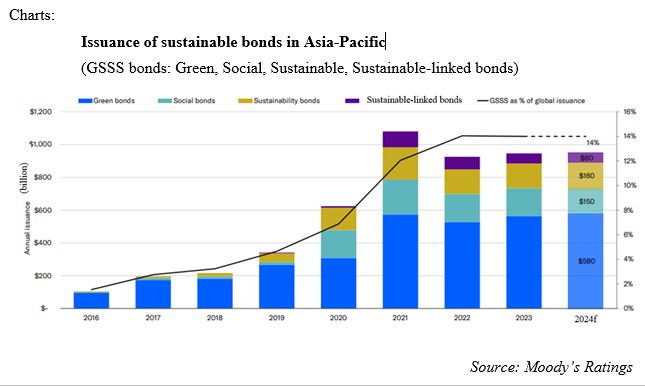

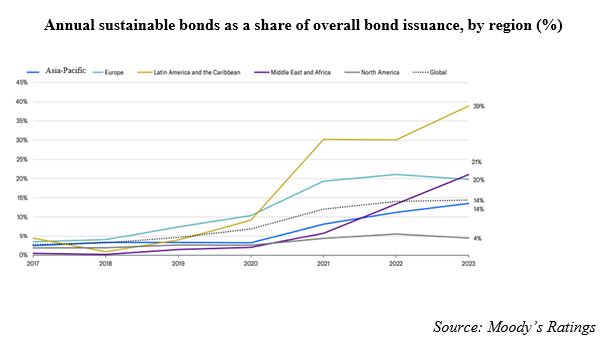

Europe and the Asia-Pacific currently lead in terms of total issuances of green bonds, while the US, Latin America, and other supranational entities contribute only a small proportion. Though Asia’s presence in the global sustainable finance market was previously quite small, the region has seen significant growth over the past four or five years.

The issuance and share of ESG bonds in the Asia-Pacific region increased from less than 5 per cent of total bond issuances in 2019 to about 14 per cent in 2024. Mr. Lee predicts that this figure will continue to rise, potentially reaching levels comparable to Europe, where ESG bonds account for about 50 per cent of all bond issuances. Large corporations in Asia are also actively investing in sustainable finance, focusing on areas such as renewable energy, green building construction, and improving energy efficiency. Therefore, investing in sustainable finance is playing a strong catalytic role in the issuance of green bonds in the Asian region.

“Specifically in Vietnam, Moody’s Ratings greatly appreciates the green bond framework at the Bank for Investment and Development of Vietnam (BIDV),” Mr. Lee said. “This framework not only complies with the principles of the International Capital Market Association (ICMA) but also excels in best practices.”

BIDV has also invested in renewable energy projects such as solar and wind energy farms as well as electric and hybrid vehicle projects, demonstrating its strong commitment to the sustainable financial market.

Boosting green bond issuances

In regard to the sustainable quality score (SQS) of green bonds, scores in Asia are still slightly lower than those in Europe and the Americas. Some 85-87 per cent of green bonds in Europe and the Americas have high SQS, compared to 77 per cent in Asia. This discrepancy is partly because the Asia region focuses greatly on heavy industry and manufacturing, leading to lower project quality compared to regions focused on services.

Furthermore, more than 40 per cent of companies in Asia lack data on their decarbonization roadmap, and 26 per cent have declared no specific targets. This is in stark contrast to Europe, where 45 per cent of companies have committed to achieving a decarbonization roadmap. This disparity indicates that Asia needs to make greater efforts to meet global decarbonization and sustainable development standards.

However, according to Mr. Lee, in November 2023, Moody’s Ratings received positive feedback from investors on creating transitional products, enhancing clarity in the sustainable finance market. He therefore predicts that green transition initiatives will drive sustainable bond issuances in the Asia-Pacific region post-2024.

At the same time, increased regulatory oversight and investor interest will continue to drive the development of sustainable financial markets. Climate change mitigation plans will be an essential part of companies’ strategies to ensure sustainable development and minimize financial and reputational risks.

Google translate

Google translate