German companies continue to view Vietnam as a promising investment destination amid a globally volatile environment, stated the “AHK World Business Outlook - Spring 2025” (the report), released recently by the Delegation of German Industry and Commerce in Vietnam (AHK Vietnam).

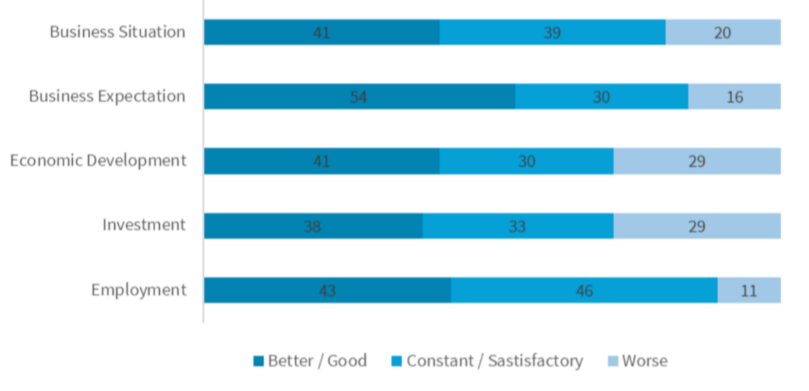

Despite persistent global disruptions, 54 per cent of German businesses operating in Vietnam anticipated an improvement in their business situation over the coming year, according to the report.

Notably, 80 per cent of surveyed firms rated their current business conditions as either “good” or “satisfactory,” reflecting a relatively stable operating environment. This confidence is further evidenced by future plans: 38 per cent of companies intend to increase their investments, while 43 per cent expect to expand their workforce in 2025.

“These figures reinforce Vietnam’s dual role as both a manufacturing stronghold and a strategic alternative hub for German businesses repositioning in the Indo-Pacific region,” the report emphasized.

Several German firms expanded their footprint in Vietnam over the past year. For instance, Ziehl-Abegg inaugurated a $20 million factory in the southern province of Dong Nai, specializing in ventilation and drive technology, while Kärcher opened a $19.4 million cleaning equipment plant in the central province of Quang Nam.

Most recently, in April 2025, the Südwolle Group officially launched its new $21 million dyeing facility in Ninh Thuan, a province in the south central coastal region of the country.

According to data from the Ministry of Finance (MoF), in the first quarter of this year, Germany invested in 7 new projects in Vietnam with a total registered capital of $11.35 million, up 81.2% year-on-year. Accumulately, as of the end of February 2025, Germany has had a total of 490 valid projects in Vietnam, with a total registered investment capital of $2.81 billion.

However, alongside these positive developments, German companies continue to face three key challenges in Vietnam, according to the report.

The first is fluctuating demand. German companies in Vietnam may not be directly affected by declining demand from the United States, but many rely on suppliers or partners serving the US market. This indirect exposure introduces uncertainty in business forecasting, planning, and expansion particularly in manufacturing and trade.

The second challenge lies in economic frameworks. Sudden policy shifts and ambiguities in the legal environment make it difficult for foreign enterprises to commit to long-term decisions.

The third issue is unequal treatment in trade. Some German companies report facing unfair competition, with local businesses receiving preferential treatment. Additionally, rising import taxes have affected firms that export directly to overseas customers and manage logistics and delivery themselves.

Nonetheless, the report underscored that Vietnam’s position as a neutral, ASEAN-based manufacturing hub presents a compelling opportunity. With the EU-Vietnam Free Trade Agreement (EVFTA) in effect, more German firms are looking to deepen their engagement, not only viewing Vietnam as a growing market, but also as a strategic partner in their global supply chain strategies.

Google translate

Google translate