As Vietnam aims for a low-carbon growth model and for carbon neutrality by 2050, the International Finance Corporation (IFC), in partnership with the Swiss State Secretariat for Economic Affairs (SECO), is scaling up its support to the Vietnamese Government to promote sustainable finance and spur private sector investment, to help the country implement its climate commitments.

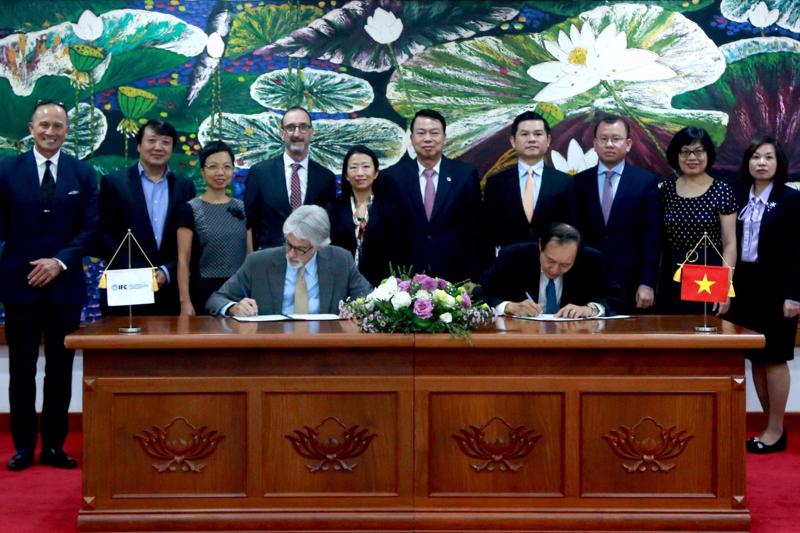

A new MoU with the State Securities Commission of Vietnam (SSC) signed on November 11 will support government efforts to leverage the capital market to tackle climate change through green and sustainable finance. With the IFC’s assistance, the SSC will promote the adoption of environmental, social and governance (ESG) standards and practices and enforce these requirements among market players.

This will also help strengthen the sustainable finance framework, encouraging innovative financial products such as green bonds, transition bonds, and sustainability-linked bonds to attract international investors looking for sustainable assets. “Capital markets have a big role to play in Vietnam’s transition to a climate-resilient and low-carbon economy, helping mobilize green capital,” said Deputy Minister of Finance Nguyen Duc Chi.

Mr. Pham Hong Son, Vice Chairman of the SSC, said promoting green and sustainable finance is a long-term priority for the Commission. “The IFC’s continued efforts to encourage the adoption of ESG standards and practices among public companies will help scale up green finance, creating a sustainable capital market in Vietnam,” he believes.

Such efforts are part of a new initiative between the IFC and SECO, called the Integrated ESG Program, to help regulators, investors, companies, and partners in Vietnam manage ESG risks and bottlenecks by promoting effective decision-making and environmental and social (E&S) risk management.

“Strengthening ESG capacity is critical to achieving the climate commitments and the Sustainable Development Goals (SDGs),” said Mr. Werner Gruber, Head of the Swiss Cooperation Office in Vietnam. “Failure to consider ESG risks can lead to poor and unsustainable investment decisions. Our work with the IFC aims to improve ESG standards and practices in Vietnam to guide financial flows towards sustainable investments for more inclusive and sustainable economic development.”

In using the IFC’s ESG standards - its Performance Standards and Corporate Governance Methodology - the integrated ESG approach addresses critical topics, including effective environmental and social risk management and systems, disclosure and transparency, climate risk, and mitigation and gender.

In addition, Mr. Kim-See Lim, IFC Regional Director for East Asia and Pacific, said that greening the capital markets with a focus on improved ESG standards is a priority as Vietnam aims to unlock private investment to achieve its twin goals of becoming a high-income and carbon-neutral economy by 2050.

“The IFC is excited to deepen its partnership with the SSC and SECO to help spur an environment conducive to private sector climate investment, which is vital for supporting sustainable and resilient growth in Vietnam,” said Mr. Lim.

One of the most vulnerable countries to climate change and natural disasters and also one of the most carbon-intensive economies in Asia, the government of Vietnam aims to decarbonize the economy and achieve carbon-neutral status by 2050, as committed at the 2021 United Nations Climate Change Conference (COP26) in Glasgow last year. This will require huge investments over the next 30 years, with State resources meeting only part of financial needs.

Google translate

Google translate