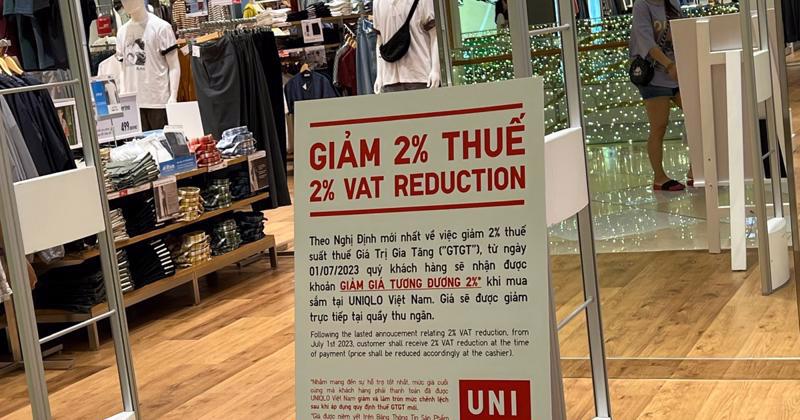

The National Assembly has agreed to apply a 2% reduction to the VAT rate for specific groups of goods and services from July 1 to the end of the year.

The policy is part of a resolution which was approved by the legislature on June 29.

The 2% reduction is applicable to products and services subject to a 10% rate.

However, it excludes some groups of products and services, including telecommunications, financial activities, banking, securities, insurance, real estate business, metals and prefabricated products, mining products (excluding coal mining), coke coal, refined petroleum, and chemical products; goods and services subject to special consumption taxes; and information technology under information technology laws.

Last November, the NA also agreed to a 2% reduction of the VAT rate for the first half of 2024.

Google translate

Google translate