Vietnam International Bank (VIB) held its annual general shareholders’ meeting (AGM) in Ho Chi Minh City on April 2, which approved a dividend distribution plan at a rate of 29.5 per cent, comprising cash dividends and stock dividends, and a pre-tax profit plan of VND12.045 trillion (nearly $482 million) for fiscal year 2024.

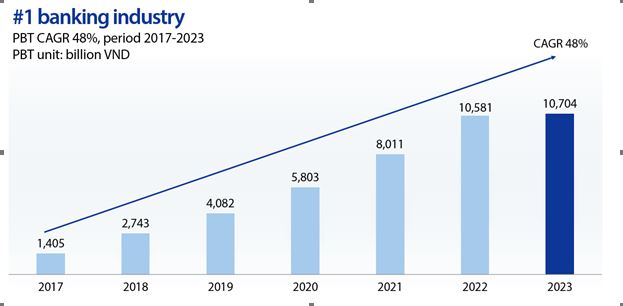

VIB is a top performing bank, with a compound annual growth rate (CAGR) in profit of 48 per cent over the past seven years of transformation.

According to a report presented by the Board of Directors at the AGM, after seven years of its ten-year strategic transformation journey (2017-2026), VIB has established a solid foundation for outstanding growth in scale, quality, and brand value, positioning itself as the leading bank in terms of business efficiency, asset and revenue growth, cost-effective management, and stringent risk control.

VIB’s profits have achieved a remarkable CAGR of 48 per cent over the past seven years, with a return on equity (ROE) of 25 per cent, leading the industry for several consecutive years. Key indicators related to revenue growth, operational efficiency, and cost control all surpassed the average of the top 10 listed banks.

Consistent with its strategy to become Vietnam’s leading retail bank in terms of scale and quality, VIB currently maintains the top position in retail with over 85 per cent of its credit portfolio dedicated to retail lending. The bank consistently leads market share in critical business segments such as home loans, auto loans, and credit cards.

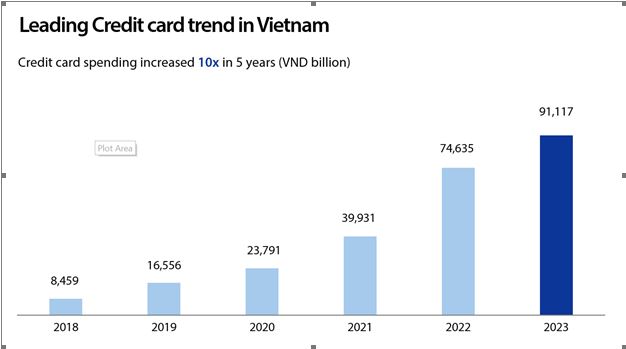

In 2023, with a trend-leading strategy in credit cards, VIB continued to introduce various new card lines to the market, featuring superior product features and first-time introductions in Vietnam. After six years, total credit cards in force reached over 700,000, an eight-fold increase, with customer spending through VIB credit cards growing over ten-fold, reaching a total of $4 billion in 2023, maintaining its top position in MasterCard’s market share in Vietnam.

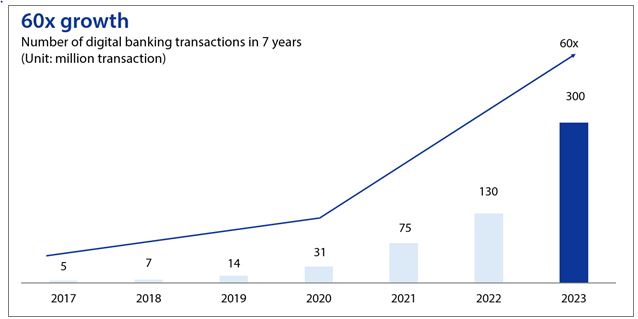

VIB’s digital banking ecosystem continues to expand, offering a diverse range of products and services to cater to various customer needs. This expansion played a significant role in helping VIB acquire an additional 1 million new customers in 2023. The number of transactions on the digital platform exceeded 300 million, representing growth of over 130 per cent compared to 2022 and a staggering 60-fold increase over the past seven years. This has led to digital channels accounting for 94 per cent of total retail transaction volumes.

Robust risk management, continuously strengthened brand reputation

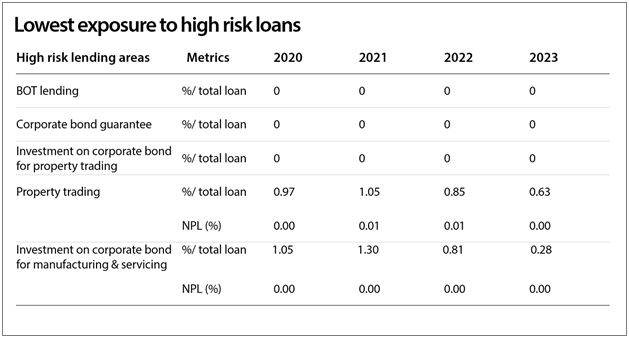

According to the Board of Directors’ report, VIB has the highest retail lending ratio in the market, with over 85 per cent of its lending allocated to retail. Alongside maintaining the best risk diversification level in the market, VIB also exhibits a cautious risk appetite by maintaining zero exposure in high-risk areas such as BOT lending, corporate bond guarantees, and real estate business bond investments over the last four years.

In 2023, the State Bank of Vietnam (SBV) continued to rank VIB in the highest group within the industry based on assessments of capital safety, asset quality, management capacity, profitability, liquidity management, and sensitivity indicators. VIB consistently complies with SBV indicators and regularly pioneers the adoption of international standards, including Basel II, Basel III, and IFRS

Approval from shareholders to raise charter capital and apply dividend distribution plan

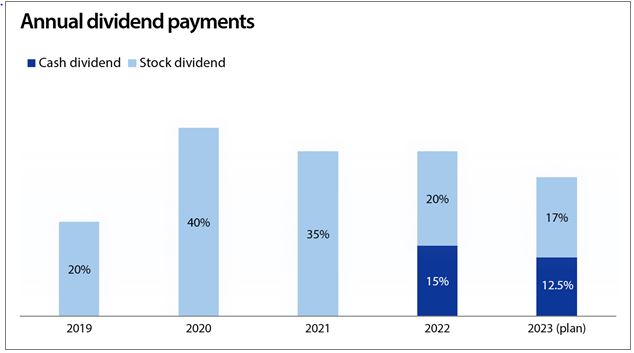

The plan to raise charter capital to VND29.791 trillion (nearly $1.2 billion), representing a 17.44 per cent increase, was approved at the meeting. Shareholders also consented to the plan to distribute a 29.5 per cent dividend to shareholders, comprising a 12.5 per cent cash dividend and a 17 per cent stock dividend. VIB has consistently maintained a balanced and generous dividend distribution policy over the years, bolstering shareholder trust and loyalty while also furnishing essential resources for the bank to pursue its growth plans.

Approval of 2024 business plan and implementation of new strategic directions

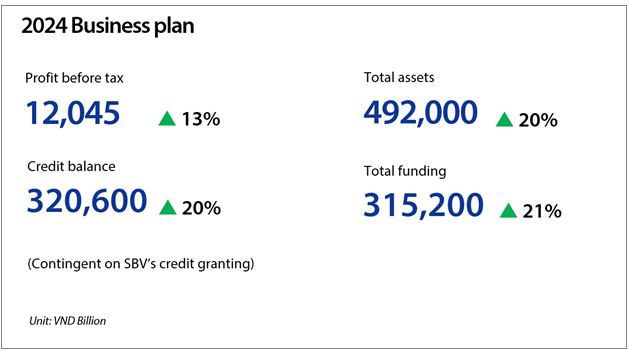

The meeting approved the proposed 2024 business plan presented by the Board of Directors, which includes targets for total assets, loan portfolio growth, capital mobilization, and profit. Specifically, the lending growth target may be adjusted depending on space determined by the SBV.

In the next phase, VIB sets out sustainable growth targets, leading in robust governance practices, pioneering in digitization, and consistently aiming to become the top retail bank in terms of quality and scale in Vietnam. This will drive dynamic and sustainable growth in shareholder value. To achieve the business goals for 2024 and the strategy for the remaining three years of the transformation journey, VIB’s Board of Directors has identified six strategic directions, as follows:

- Innovative and superior customer solutions and products.

- Excellence in technology and digital banking.

- Empowerment in human resources.

- Leading brand.

- Pioneering the adoption of international standards.

- Robust risk management and compliance.

During the AGM, VIB’s Chairman also conveyed its commitment to aggressively expand its retail operations, striving to realize its vision of becoming Vietnam’s leading retail bank in both quality and scale. Furthermore, VIB aims to become the premier banking partner for enterprises and to uphold its reputation as a dependable and trustworthy ally for financial institutions across various areas, including currency, capital markets, and foreign exchange.

Google translate

Google translate