Behind traditional savings, cryptocurrency has become Vietnamese consumers’ second-favorite investment choice for the next 12 months, according to the Financial Trends Report 2023 from Decision Lab.

Consumers expect to remain cautious with their personal finances, with around half of respondents investing in savings, gold, and securities planning to continue investing more in the next 12 months. However, digital currencies buck this trend. Despite being one of the most volatile asset classes, just over half (52 per cent) of Vietnamese who own crypto plan to invest more in assets like Bitcoin.

According to the survey, with the job market becoming more precarious, more people are turning to investment products to protect their families’ financial future. In 2023, 41 per cent of people hope to safeguard their financial future through investing, up 10 per cent from 2022.

However, even though investing is becoming more popular, consumers are more cautious regarding their risk appetite. The number of people willing to take a “high” to “extreme” risk to achieve significant capital growth has halved from 18 per cent to just 9 per cent in 12 months. Meanwhile, just 19 per cent of people prefer to take no risk, around one-third (32 per cent) are low-risk investors, and just over one-fifth (23 per cent) are willing to take a moderate risk when investing their capital.

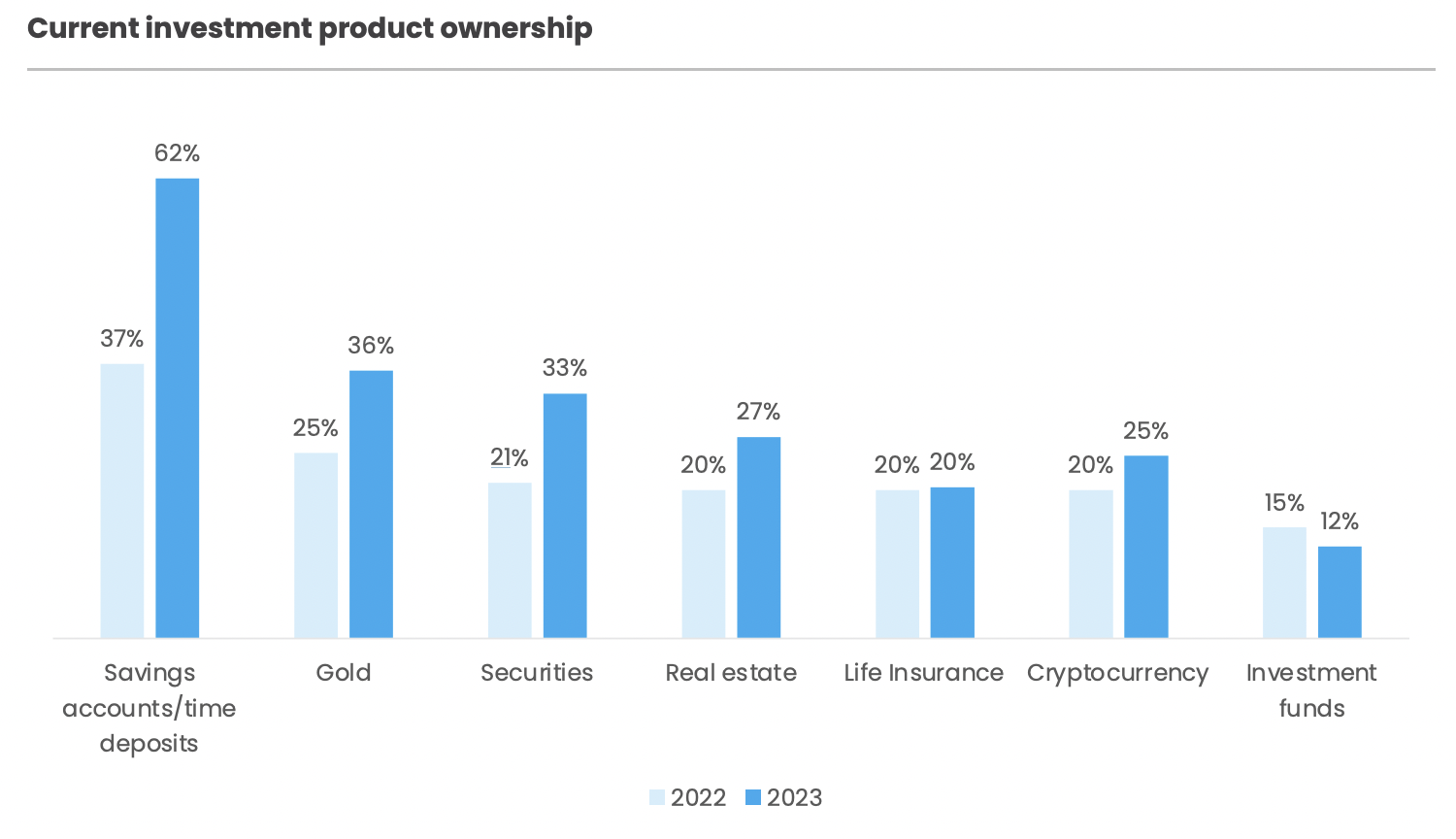

For this reason, safe-haven investments have soared over the last 12 months. The number of people with a savings account, for instance, has almost doubled from 37 per cent in 2022 to 62 per cent in 2023.

Meanwhile, the proportion of the population investing in securities has risen from around one-fifth (21 per cent) to one-third (33 per cent) over the last 12 months. Real estate and cryptocurrency also saw an increase in the proportion of investors, with the number rising from 20 per cent to 27 per cent in real estate and from 20 per cent to 25 per cent in crypto.

Commenting on the data, Mr. Thue Quist Thomasen, CEO of Decision Lab, said that in uncertain times, consumers want financial products that can help them to ride out rising food costs, falling house prices, and unpredictable job prospects. People want to protect themselves and their families from financial hardship, with low-risk investment products providing an attractive hedge against an uncertain future.

“Therefore, banks and financial institutions looking to attract customers need to respond to this trend,” he said. “That means providing savings and investment products offering trustworthiness, transparency, and security while also showcasing these values through their marketing messages and brand campaigns.”

Google translate

Google translate