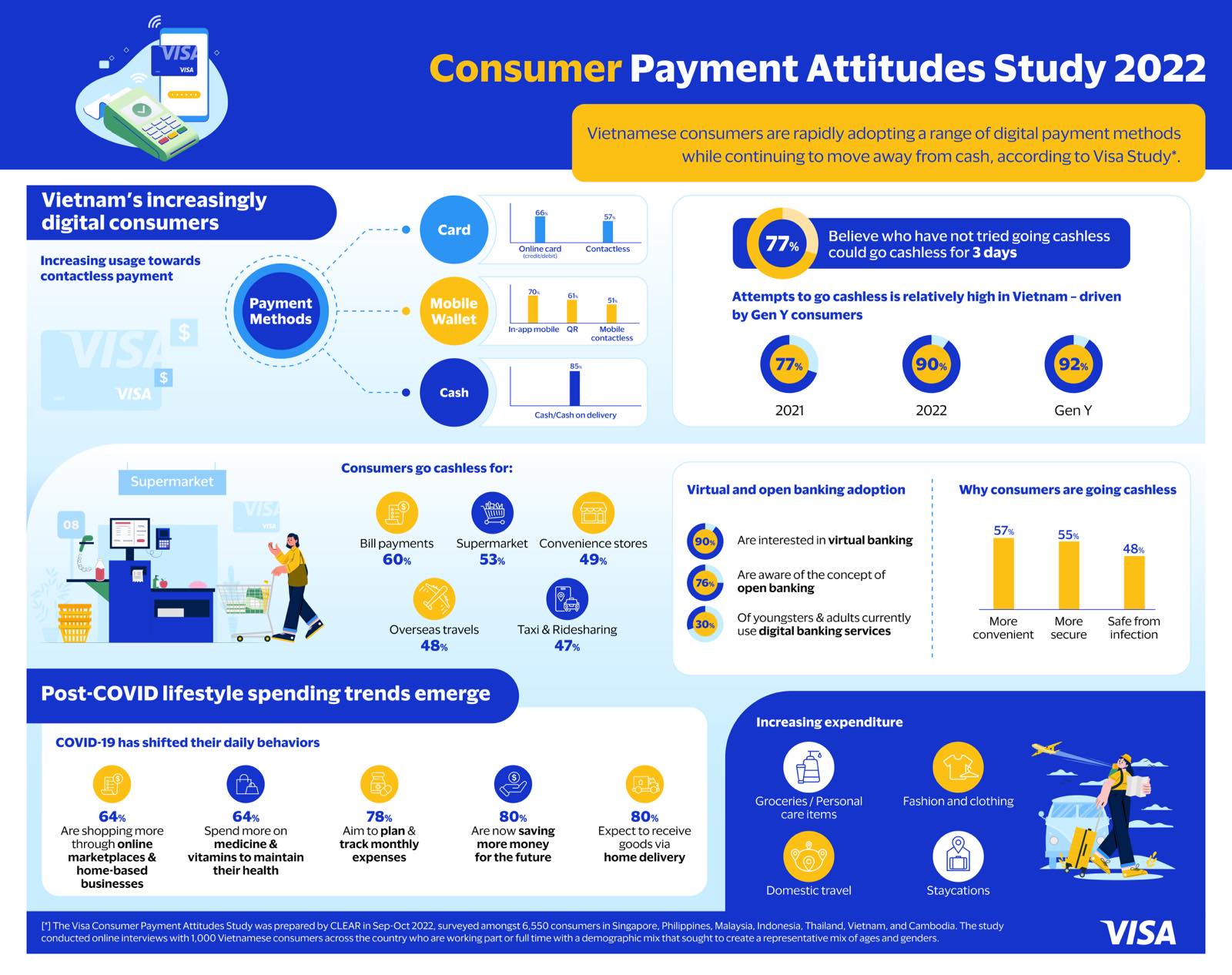

Vietnamese consumers are rapidly adopting a range of digital payment methods while continuing to move away from cash, according to Visa’s Consumer Payment Attitudes Study for 2022.

“Digital payments continue to grow in popularity among consumers in Vietnam, with VisaNet data showing that the payment volume across all Visa payment methods in the country rose 32 per cent year-on-year in 2022, while the payment value through online transactions also rose substantially and cross-border payment volume growth more than doubled compared to the previous year,” said Ms. Dung Dang, Visa Country Manager of Vietnam and Laos.

As consumers continue to embrace digital payment methods and lifestyle trends, Visa is proud to accompany them on this journey with innovative products and services supplemented by unparalleled security, she added.

According to the study, the Covid-19 pandemic transformed consumer behavior worldwide and Vietnam was no exception. The percentage of Vietnamese consumers using cards or mobile wallets has increased in every category compared to 2021.

Sixty-six per cent of Vietnamese consumers used online card payments last year, while 70 per cent used online or in-app mobile wallet payments; a dramatic increase from 32 per cent in 2021. QR payments also experienced substantial growth last year, with 61 per cent of consumers using this method compared to 35 per cent in 2021. Seventy-seven per cent believe they could go cashless for three days, and 90 per cent attempted to go cashless at some point in 2022, compared to 77 per cent in 2021.

Taken together, this indicates a gradual shift away from cash, evidenced by the fact that consumers both carried less cash in 2022 and used it for fewer payments. The two most common reasons for carrying less cash are the possibility of losing it or having it stolen, and the fact that more businesses now support cashless payment methods.

Increased use of digital options is evident beyond payment methods as well. About 90 per cent of Vietnamese consumers are interested in virtual banking. There is enormous potential for digital banking in Vietnam, as only 30 per cent of Vietnamese adults currently use digital banking services. With healthy annual growth in digital payment values predicted in the coming years, businesses are on the cusp of a great opportunity to expand their services in the country.

Open banking, on the other hand, is still in its infancy in Vietnam, though 76 per cent of consumers are aware of the concept. Vietnamese consumers are most interested in the ability of open banking to provide product and service comparisons across multiple banks, and the ability to schedule payments and transfers.

Regarding post-Covid consumer behavior, the study shows that Vietnamese have embraced home delivery, with tech-enabled online payment pre-delivery being the most popular method. Overall, 85 per cent of consumers tried home delivery for the first time during the pandemic, and in the future they expect eight out of ten purchases to be made online and received via home delivery. Offering online payment and home delivery are clear needs for businesses moving forward.

New shopping habits have also emerged, with 64 per cent of consumers purchasing more medicine and vitamins to maintain their health, while the same percentages are shopping more through large online marketplaces and home-based businesses.

Shifting saving and spending trends, meanwhile, mean businesses must adapt to different behavior. About 80 per cent of consumers say they are now saving more money for the future, while 78 per cent aim to closely plan and track monthly expenses. This indicates a widespread focus on being financially responsible, as does the nearly universal setting of monthly budgets for household expenditures.

As a result, consumers are likely to reduce spending on certain items, which businesses must anticipate. On the other hand, businesses can move into areas where consumers plan to increase spending, including groceries, fashion and clothing, and staycations or domestic travel. In just one example of these changing habits, a majority of consumers traveled after January 2022, mostly domestic trips for leisure. Moving forward, businesses will need to keep pace with the many changes in consumer behavior currently underway.

Google translate

Google translate