Vietnam recorded 162,900 newly-established enterprises in the first ten months of 2025, with total registered capital of VND1,590 trillion ($61.2 billion) and 967,600 registered employees, according to the National Statistics Office at the Ministry of Finance.

All key indicators increased year-on-year, with the number of new businesses up 19.7 per cent, total registered capital 21.4 per cent, and registered jobs 18.6 per cent. Average registered capital per new enterprise stood at VND9.8 billion ($377,000); a slight increase of 1.4 per cent, suggesting that the number of newly-established enterprises remains stable.

Mixed landscape

The business landscape over the first ten months saw a record VND5,200 trillion ($200 billion) in additional registered capital injected into the economy. The figure including both new registrations and capital increases from existing enterprises surged 98.2 per cent year-on-year, reflecting growing confidence among businesses about expanding investment and production.

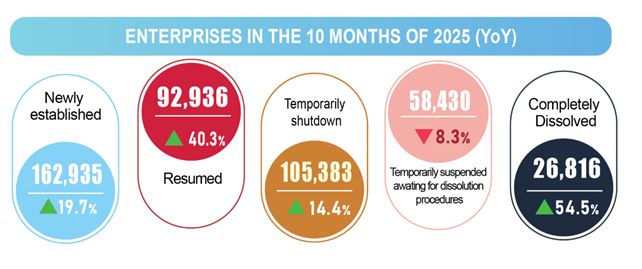

Along with the rise in new enterprises, the number of those resuming operations after a period of suspension also climbed sharply, to 92,900, up 40.3 per cent. In total, 255,900 new and returning enterprises joined the market in the first ten months, an increase of 26.5 per cent year-on-year. On average, 25,600 businesses entered or re-entered the market each month.

By sector, services continued to dominate, with 124,800 new enterprises, up 21 per cent, followed by industry and construction with 36,600, up 16 per cent, and agriculture, forestry, and fisheries with 1,534, an increase of 11.7 per cent.

Beneath the upbeat numbers, however, the business environment remained highly competitive. In the period, 105,400 enterprises temporarily suspended operations, up 14.4 per cent, while another 26,800 completed dissolution procedures, up a substantial 54.5 per cent, and 58,400 halted operations pending dissolution, down 8.3 per cent.

On average, 19,100 enterprises withdrew from the market each month. In October, 6,065 suspended operations, 6,771 awaited dissolution, and 4,536 completed dissolution, for an increase of 128.3 per cent compared to October 2024.

The contrasting trends show that while entrepreneurial energy remained strong, mounting competitive pressures and persistent barriers in the business environment continued to force many enterprises to exit the market.

Sustaining business growth

Vietnamese businesses face mounting challenges, from longstanding structural problems to newly-emerging legal barriers. The Vietnam Industrial Park Finance Association (VIPFA) pointed to overlapping and inconsistent regulations across core laws such as those on Investment, Land, Construction, and Environmental Protection. These inconsistencies in procedures and authority often force investors to duplicate paperwork and repeat approval steps, delaying projects, especially in land access, environmental assessment, and fire safety certification.

Operational hurdles remain equally pressing. Tax incentives are often unclear and inconsistently applied, while extended VAT refunds continued to strain cash flow, particularly for newly-launched FDI projects. Customs procedures, though being reformed, still suffer from inconsistent goods classification and HS code application, leading to disputes and potential tax arrears. Overlapping specialized inspections further delayed clearance at ports, adding to logistics costs.

Even in the food and health sectors, the business community has voiced concern. EuroCham’s Nutritional Foods Group Sector Committee warned that draft amendments to Decree No. 15/2018/ND-CP will significantly increase procedural complexity, requiring up to 600 per cent more documentation and prolonging appraisal times by 1,400 per cent. Proposed changes risk both the exposure of proprietary technical information and product spoilage, such as fresh milk requiring a 21-day review despite a 10-day shelf life.

Beyond external barriers, many small and medium-sized Vietnamese enterprises also struggle internally with limited financial transparency and compliance capacity, especially amid digital transformation. The root of these challenges often lies in business owners’ attitudes towards governance and legal responsibility.

To meet ambitious GDP growth targets of more than 8 per cent this year and double-digit growth in subsequent years, with 2 million active enterprises contributing 55-58 per cent of GDP by 2030, as set by Politburo Resolution No. 68-NQ/TW, removing these bottlenecks is essential.

The business community’s top priority is a more coherent and predictable legal framework. Laws governing land, investment, and construction must be harmonized to remove overlaps. Administrative reform should move towards a genuine one-stop, interconnected digital process that reduces face-to-face interactions and paperwork.

Enterprises also urge a shift from pre-approval to post-inspection based on risk management; an approach widely adopted internationally. Instead of complicated pre-checks, the State should set clear technical standards, grant greater autonomy to businesses, and focus enforcement efforts on surprise audits and strict penalties for violations.

At the same time, companies must take greater responsibility for strengthening their own management and financial systems. The ongoing digital transformation in the tax sector exemplifies this shift. In the first nine months of 2025, the number of inspections fell 21.6 per cent thanks to AI and big data, but total tax revenue rose 22.1 per cent. This underscores the growing need for transparency, proactive compliance reviews, and internal risk control in areas such as invoicing, transfer pricing, and contractor taxation.

To succeed, businesses need a clear roadmap and stronger institutional support to modernize operations, comply with the law, and build long-term competitiveness in an increasingly demanding environment.

![[Interactive]: Economic overview - November 2025](https://premedia.vneconomy.vn/files/uploads/2025/12/08/ec3e68f1536d4114ba47b1f76a4618ab-55183.png?w=400&h=225&mode=crop)

Google translate

Google translate