The Ministry of Finance has put forward five personal income tax (PIT) rates for taxable income in the latest PIT bill, according to a report from the Government News.

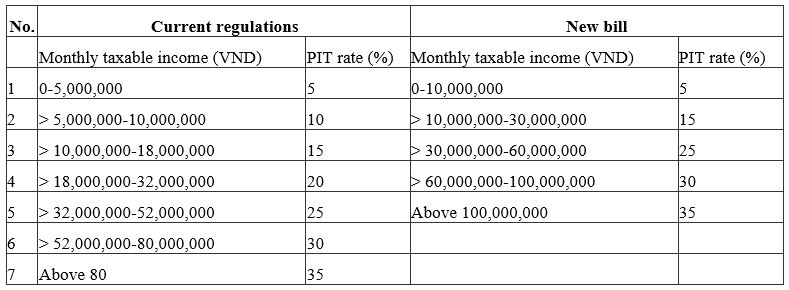

Under the bill, monthly taxable income is taxed at a progressive rate from 5 percent to 35 percent for a tax resident as in the chart below:

The above chart shows that the highest PIT rate would be 35 per cent, equivalent to that of regional peers like Thailand, Indonesia and the Philippines.

PIT has been the third largest source of State budget revenue after value-added tax and corporate income tax.

Vietnam's GDP per capita reached $4,700 in 2024, an increase of $377 from 2023. If the national economy expands 6.5 per cent over the next 20 consecutive years, the GDP per capita would be around $15,000 by 2045 and $20,000 by 2050, the Government News forecast.

Google translate

Google translate