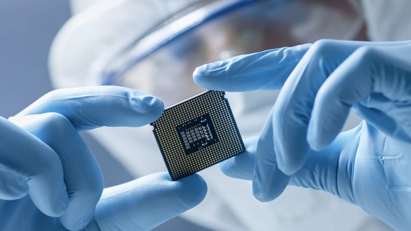

High talent demand from semiconductor industry

Standfirst: Vietnam’s target of having 10,000 engineers and graduates in the semiconductor industry by 2040 demonstrates the government’s commitment but also presents a major challenge that requires urgent and decisive action.