Vietnam is committed to actively contributing to the innovative ecosystem of the global semiconductor industry and will be a reliable partner and a key link in the global production supply chain.

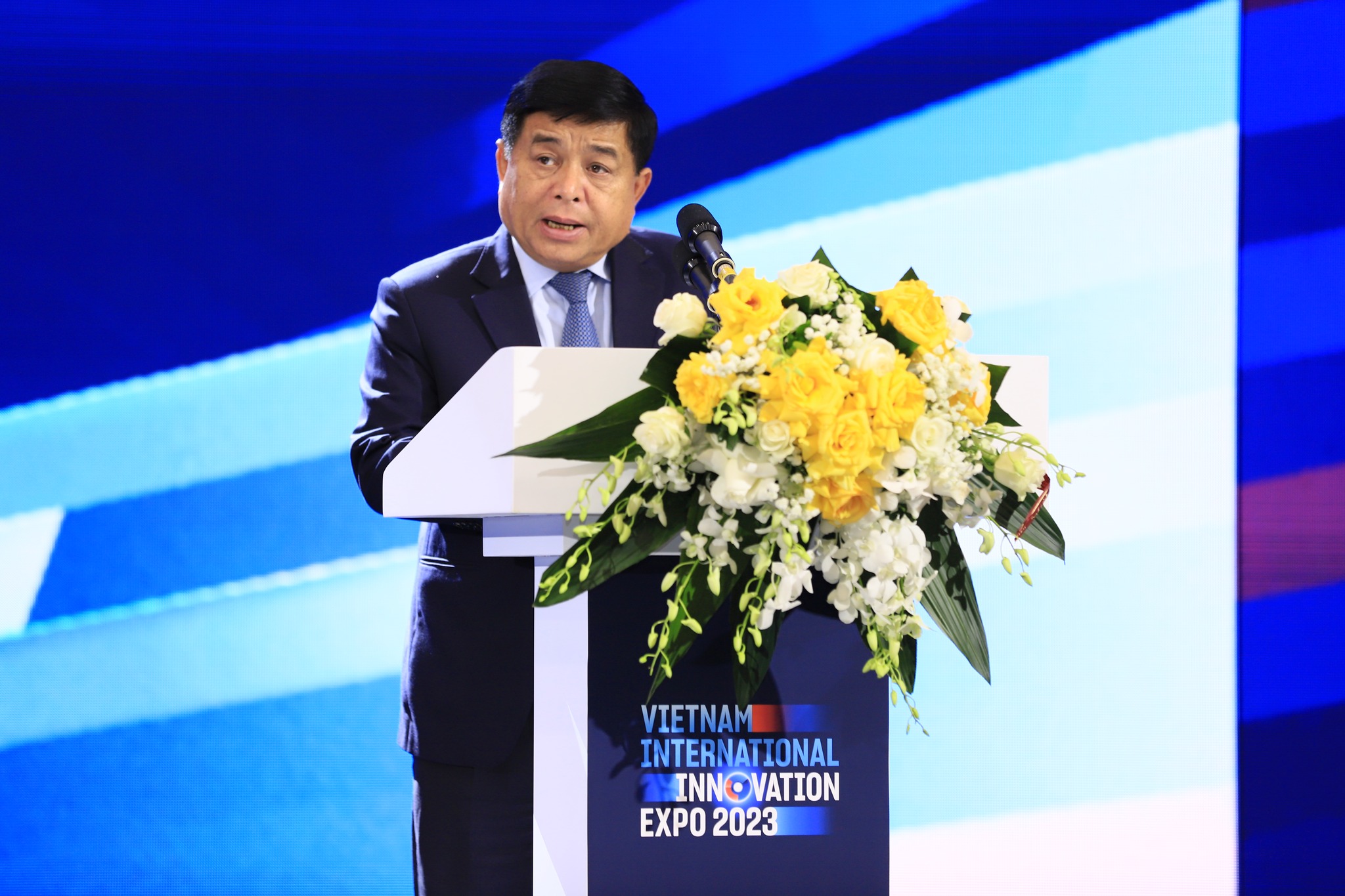

The statement was made by Minister of Planning and Investment Nguyen Chi Dung at the “Summit on Vietnam’s Semiconductor Industry”, held in Hanoi on October 29 as part of the Vietnam International Innovation Expo 2023 (VIIE 2023) in conjunction with the inauguration ceremony for the National Innovation Center (NIC) at Hoa Lac High-Tech Park. The Summit focused on discussing topics such as the current status of the semiconductor industry and opportunities for its development, human resources, and educational centers for multi-areas.

Speaking at the Summit, Minister Dung emphasized that there are five factors helping Vietnam become a crucial link in the global semiconductor production supply chain.

Firstly, with a stable political system and strategic geographical location, Vietnam prioritizes investment cooperation and growth in its semiconductor industry. The Ministry of Planning and Investment, along with the Ministry of Information and Communications and other related ministries, are therefore actively developing action plans and strategies for the industry. A workforce development project is also in progress, to create a team of 50,000 engineers for the industry by 2030.

Secondly, Vietnam has an abundant engineering and technology workforce that is suitable for the semiconductor industry. There are reputable research and training institutions in the semiconductor field and major enterprises with resources and readiness to cooperate in the industry’s development, including Viettel, VNPT, FPT, and CMC.

Thirdly, Vietnam is increasingly attracting major semiconductor corporations from the US, South Korea, Japan, Europe, Taiwan (China), and elsewhere. During US President Joe Biden’s visit to Vietnam in September, the two countries elevated their relationship to a Comprehensive Strategic Partnership, highlighting innovation as a key area of cooperation, including the development of the semiconductor industry. And during Prime Minister Pham Minh Chinh’s visit to the US a week later, significant discussions were held with the Semiconductor Industry Association (SIA) and leading global semiconductor corporations.

Fourthly, Vietnam has been introducing various attractive investment incentives for semiconductor companies and corporations. Investment projects in the high-tech field can receive the highest incentives under Vietnamese law.

And fifthly, Vietnam has now established the NIC and three high-tech zones in Hanoi, Ho Chi Minh City, and Da Nang, all of which are equipped with the infrastructure needed to welcome semiconductor investors and offer preferential policies. The NIC and these high-tech zones will serve as crucial bridges to support the development of Vietnam’s semiconductor industry ecosystem.

Mr. John Neuffer, President and CEO of the SIA, noted that Vietnam is a crucial link in the global semiconductor supply chain and is poised to become even more important. “The country already has a footprint in back-end assembly testing and packaging,” he said. “In fact, over half of Intel’s assembly testing happens right here in Vietnam. It is very impressive. Vietnam is also becoming a larger link when it comes to front-end chip design.”

In addition, he went on, Vietnam has made inroads in attracting R&D into the sector, and understands the need to grow more semiconductor talent. It has been providing tax and other incentives to attract chip sector investment. Many companies are expanding their investments, which is testament to Vietnam’s pivotal and growing role in the global semiconductor supply chain.

“I can’t say enough about how important the workforce challenge is for our industry,” he said. “Our entire industry is experiencing a talent shortage across the globe. So Vietnam’s plan to produce 50,000 more chip engineers is absolutely the right objective. And I hope it will be achieved as soon as possible. Competing on talent is a very smart move.” He also noted that the sector is moving quickly to rebalance supply chains following chip shortages, and to have sufficient manufacturing capacity in place around the world to provide the chips needed to supply what is projected to be a $1-trillion demand for semiconductors by 2030. So there is furious global competition underway to attract investment from the industry, and the window of opportunity will not remain open forever.

For his part, Mr. Chang-wook Kim, Boston Consulting Group’s semiconductor lead for South Korea, said semiconductors are a great invention for civilization. A semiconductor geographical leadership had been sustained for a long time. In the past, the semiconductor power game was followed based on labor cost and value add. Geographical dynamics were thought to be fixed due to barriers in technical difficulties. But disruptions occurred to the fixed geo dynamics, changed by several factors and a butterfly effect from US chips, which influenced countries to dream about having a semiconductor business or self-support capacity. As a result, the semiconductor geography has shifted. This is a great opportunity for Vietnam, he believes. Many semiconductor players are setting up R&D centers and manufacturing sites, and contrary to the past, it is regarded as natural to set up semiconductor sites in other countries. Thus, now is the right time for Vietnam to capture the opportunities.

Meanwhile, Mr. ST Liew, Vice President of Qualcomm Technologies, believes that with world-class infrastructure and an abundance of engineering talent, Vietnam has the potential to become a regional a hub for semiconductors and perhaps even a global hub.

“The semiconductor industry is not easy at all,” he explained, noting that many countries are rolling out programs that incentivize and attract investment. But, he went on, the semiconductor supply chain is a global phenomenon. It used to be just smartphones, but now almost everything you can imagine relies on the chain. For example, a smartphone has more than 165 semiconductors. No single semiconductor company, nor a single country, can execute the end-to-end value chain of producing semiconductors. “So, we believe that Vietnam will have to choose in which part of the value chain it will play a role,” he told the Summit. “And after that decision is made, consider the relevant aspects of the ecosystem in the supply chain, in the value chain, and so on.”

Google translate

Google translate