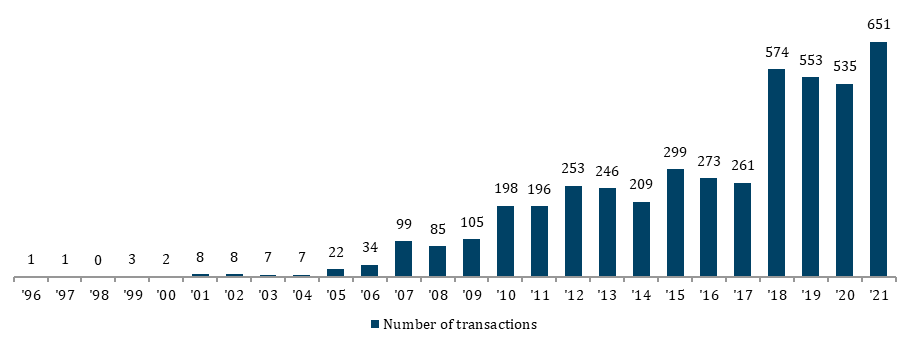

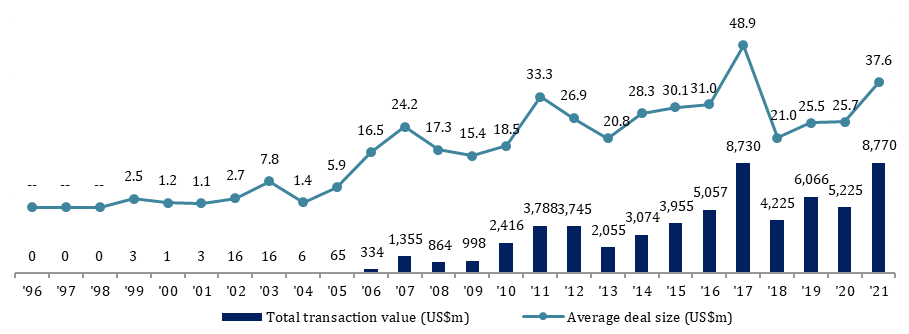

Over the last 25 years, Vietnam has transformed from a low-income country into one of the fastest-growing economies in the world, with GDP per capita increasing nearly ten-fold from 1996 to 2021, supported by a strong socio-economic backbone of a young population and a rapidly-growing middle class. Along with economic growth, merger and acquisition (M&A) activities in Vietnam have also soared, driven by progress in equitization and market liberalization, as evidenced by supportive market regulations for foreign investors. From the quiet days of a handful of small value deals in the late 1990s, Vietnam’s M&A market has been recording over 500 deals each year recently. Larger deals have become more common, with 62 valued at $100 million or more over the last five years. Although challenges remain, the outlook for M&A activities in Vietnam is bright, especially as border restrictions have been relaxed and the country is heading towards post-pandemic recovery.

Emergence of a new M&A market (1996-2004)

Vietnam’s new market economy was gradually developing in the 1990s, after extensive socio-economic reforms brought about by “Doi Moi” policies since 1986. In 1995, Vietnam became a member of ASEAN as part of efforts to rejoin the global economy and attract foreign investment. The early days of M&A activities in Vietnam in the late 1990s to early 2000s were relatively quiet, with no apparent trend, as its economy was still largely dominated by State-owned enterprises (SOEs). There were fewer than ten transactions each year in this period, more than 90 per cent of which were under $5 million.

Top buyer countries: In addition to domestic investors, investors from Denmark and the US were most active, followed by those from developed countries in Asia such as Japan and South Korea. The top position held by Denmark was primarily driven by Carlsberg’s acquisition of Hue Brewery in 2003, with the addition of small-scale projects in Industrials and Information Technology backed by IFU, the Denmark-based development fund.

Top sectors: Consumer and Financial Services dominated in deal value, driven by (i) Vietnam’s gradual emergence from low-income status at the turn of the 21st century, and (ii) the Vietnamese Government’s plan to revamp its nascent banking system with foreign investment.

Booming M&A activities due to market liberalization (2005-2013)

From only a handful of deals a year from 1996 to 2004, M&A activities in Vietnam skyrocketed to over 150 deals on average a year in the 2005-2013 period. Deal value and number of deals fell briefly from 2007 to 2009 due to the impact of the global financial recession, before rebounding in later years and peaking in 2011 and 2012 with a number of high-value deals. Transaction size significantly improved, with 90 transactions having over $50 million in value.

M&A activities in Vietnam increased significantly in this period due to:

- An influx of foreign capital into SOEs: Major examples are investments by major Japanese banks such as Mizuho and Sumitomo in Vietcombank and Eximbank;

- A strengthened regulatory framework, as the 2005 Enterprise Law came into effect;

- Open market access for foreign investors: Vietnam became a member of the WTO in 2007, committing to one of the world’s most progressive market access programs.

Top buyer countries: Domestic investors took the top spot with a number of sizeable transactions and many smaller ones (90 per cent of domestic deals were under $10 million). The largest deals from domestic investors had two notable trends:

- M&As in Financial Services, with top deals such as SHB’s $168 million acquisition of Habubank and Eximbank’s acquisition of a 9.6 per cent stake in Sacombank for $100 million in 2012;

- Local conglomerates’ expansion strategies, with top deals such as Masan’s acquisition of (i) an 85 per cent stake in Nui Phao Mining for $100 million in 2010, and (ii) a 40 per cent stake in Vietnamese-French Cattle Feed (Proconco) for $96 million in 2012.

Among foreign investors, buyers from Japan, France, the US, and Singapore were among the most active, with eleven transactions surpassing the $100 million mark.

Top sectors: Financial Services overtook Consumer to be the top area of focus for M&As and foreign investments, driven by market consolidation and the restructuring of Vietnam’s banking system. Industrials remained in the top 3, attracting M&A activities from foreign investors due to Vietnam’s potential in natural resources and low labor costs.

Record-breaking deal flow (2014-2021)

In the 2014-2021 period, annual average deal count increased more than three-fold to over 450. Transaction size also significantly improved, with 196 transactions having over $50 million in value; more than double the figure in the 2005-2013 period. 2017 was a record-breaking year in terms of transaction value, driven by ThaiBev’s acquisition of a 53.6 per cent stake in Sabeco in 2017 for $4.9 billion; the largest deal in Vietnam to date. Overall, transaction value was on an upwards trend, peaking at $8.7 billion in 2017 before declining to $6 billion in 2019 as the US-China trade war sparked recession concerns, and $5.2 billion in 2020 due to the impact of Covid-19. However, M&A activities recovered strongly in 2021, with a record year seen in deal volume (651) and value ($8.8 billion), in line with global M&A trends and due to the unleashing of accumulated capital and pent-up deal-making demand. With economic optimism remaining high, especially given new open border policies, 2021 set a solid background for supercharged growth in M&As in 2022 and beyond.

Key drivers for record-breaking deal flows in this period include:

- Favorable regulation and market access for foreign investors:

- The 2015 Law on Enterprises and Law on Investment allows foreign investors to own up to 100 per cent of equity in listed companies in Vietnam, except for ones constrained by:

- Foreign ownership restrictions, as set out in commitments to international treaties;

- Conditional lines of business;

- Voluntary limits imposed by shareholders.

- Vietnam’s participation in major free trade agreements such as the EU-Vietnam Free Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.

Top buyer countries:

- Thai and South Korean buyers showed an appetite for large-sized deals, as evidenced by ThaiBev’s acquisition of a 53.6 per cent stake in Sabeco for $4.9 billion in 2017 and the SK Group’s acquisition of a 6.1 per cent stake in Vingroup for $1 billion in 2019;

- Singaporean and Japanese investors were more attracted to small and medium-sized transactions, with only 5 per cent of transactions having over $100 million in value;

- Deal flow involving domestic buyers, though no longer remaining at the top position, was still significant in volume, although 90 per cent of transactions were under $10 million in value. Major deals with domestic buyers included Vingroup’s acquisition of a 96.5 per cent stake in the Bao Lai JSC, a white marble mining company, for $119.8 million, and Masan’s acquisition of a majority stake in Phuc Long for over $100 million.

Top sectors:

- Information Technology emerged among the top 5, driven by private equity and venture capital investors betting on Vietnam’s dynamic internet economy, with the internet penetration rate doubling from 35 per cent in 2011 to 70 per cent in 2021 (according to the World Bank);

- Deal flow and volume in Infrastructure, Government & Utilities was driven by transactions involving renewable energy. The largest deals included Chaleun Sekong’s $99 million acquisition of the Hoang Anh Gia Lai Hydropower Plant JSC and Banpu’s $66 million acquisition of the Mui Dinh Wind Farm.

Although Real Estate M&A transactions (asset / project / land bank transfer) were not considered for M&A statistics here, it is worth noting that Real Estate also saw a boom in transaction numbers and value in the period, driven by rapid urbanization in Vietnam. There were 79 deals totaling $1.7 billion from domestic buyers and 178 deals totaling $4.4 billion from foreign investors.

Future outlook

Recent outbreaks of Covid-19 might put a temporary halt on progress in economic growth but will not reverse ongoing progress in socio-political changes in Vietnam, which will set a solid foundation for the next 25 years. Vietnam will continue to enjoy (i) a bourgeoning middle class with increasing spending power, (ii) a young population with a high urbanization rate, and (iii) stable political standing. As Covid-related restrictions have been relaxed, Vietnam’s economy is expected to strongly recover as the fastest-growing economy in ASEAN, with 6.6 per cent growth in 2022, followed by the Philippines (6.3 per cent) and Malaysia (6.0 per cent). Since 2019, factory relocations from China or other parts of Southeast Asia have been driving an influx of foreign capital; a trend expected to persist in the next 25 years as Vietnam cements its strategic importance as a manufacturing hub in the region. Market liberalization will also continue to serve as the backbone for Vietnam’s economy, with government policies focusing on free trade agreements.

Expected trends

Environmental, social, and governance (ESG) criteria will become more deeply integrated into Vietnam’s M&A market.

Private equity investors have become more active in Vietnam in recent years. Recent examples of large deals involving private equity investors include KKR’s $650 million investment in Vinhomes in 2020, $400 million investment led by Alibaba Group and Baring Private Equity Asia (BPEA) and $350 million investment by a consortium of TPG, Temasek, and the Abu Dhabi Investment Authority in The CrownXin 2021. More and more global and regional private equity firms have established a local presence in Vietnam, with dedicated investment teams and networks of advisors on the ground.

Asia-Pacific investors will continue to rank higher in deal volume compared to their European and North American counterparts.

Buyout transactions have become more common, especially due to the impact of the pandemic, which led to the consolidation of small and medium-sized players into respective market leaders. Local conglomerates such as Vingroup, Masan, and the Nova Group have all been active in acquiring targets across different industries both within and beyond their core capabilities, such as education, technology, and F&B, etc., and are expected to accelerate their expansion strategies through acquisitions in the future. Foreign investors, on the other hand, have been increasingly active in pursuing buyout transactions in Vietnamese businesses, as seen in the Stark Corporation’s acquisition of ThiPha Cable and Dovina in 2020 and SCG Packaging’s acquisition of Duy Tan Plastics in 2021, for both of which BDA served as sellside advisor. Financial sponsors have also been active in buyouts of Vietnamese companies, as evidenced in acquisitions of majority stakes in Vietnam USA Society English Centers (VUS) and Vietnam Australia International School by BPEA and TPG, respectively.

Sectors of focus include consumer, healthcare, industrials, IT/Technology, and Renewable Energy.

In conclusion, we remain confident in the availability of opportunities in Vietnam’s M&A market going forward, especially now that social distancing restrictions have been lifted and borders are expected to be fully open this year. We at BDA in Ho Chi Minh City have seen strong interest from investors looking for sizable transactions, as foreign investors interested in Vietnam have accumulated a lot of dry powder since 2020 and are ready to revive deals that were put on hold or cancelled. Meanwhile, we are also observing strong demand for growth capital and exits from both founder-backed and private equity-owned companies, as evidenced by current live deals and strong pipelines of opportunities for 2022 and beyond.

Google translate

Google translate