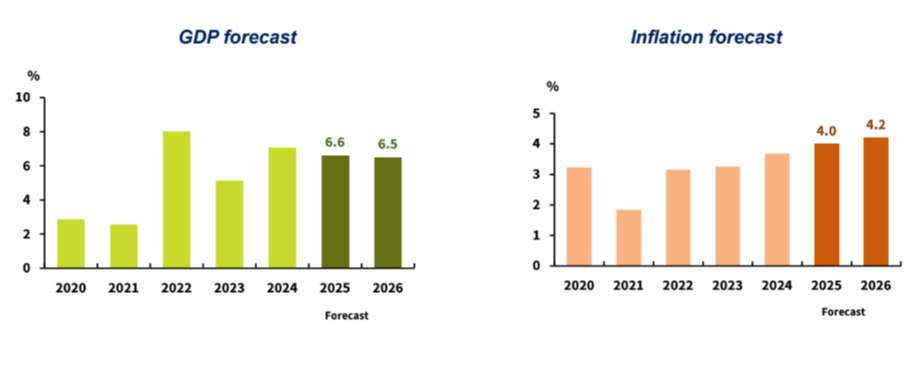

At a press conference announcing the Asian Development Outlook (ADO), held in Hanoi on April 9 by the Asian Development Bank (ADB) Vietnam Resident Mission, ADB forecast that Vietnam’s GDP would grow by 6.6 per cent in 2025 and 6.5 per cent in 2026.

According to the report, global trade tensions may negatively impact Vietnam’s export-oriented manufacturing sector this year. Although Vietnam’s total import-export turnover in the first quarter of 2025 reached $202.52 billion, up 13.7 per cent year-on-year, the ADB projects that trade growth will slow to around 7 per cent in both 2025 and 2026.

The country’s industrial sector is forecast to decelerate, with growth estimated at 7 per cent only in 2025.

In addition, pressures from global geopolitical tensions, rising domestic consumption, and the government’s push to accelerate public investment disbursement are expected to drive inflation rate up to 4 per cent in 2025 and 4.2 per cent in 2026.

According to Mr. Shantanu Chakraborty, ADB’s Country Director for Vietnam, strong trade performance, a rebound in export manufacturing, and robust foreign direct investment (FDI) inflows were the main drivers of Vietnam’s economic growth in 2024.

“However, the new US tariff policy and ongoing global uncertainties could pose significant challenges to Vietnam’s growth this year,” he stated.

Specifically, the international economic landscape is undergoing profound changes, with various risks such as escalating tariffs, retaliatory measures, the prolonged Russia–Ukraine conflict, and persistent instability in the Middle East.

Economic slowdown in two of Vietnam’s key trading partners, namely China and the United States, may further impact the country’s economic outlook. These external headwinds could hinder the pace of global recovery in the short to medium term, particularly for export-reliant economies like Vietnam.

Regarding FDI trends, Mr. Nguyen Ba Hung, ADB’s Chief Economist in Vietnam, noted that the imposition of US tariffs on Vietnam’s export could cause hesitation among investors and slow their investment activities in Vietnam, thereby affecting FDI inflows in the near future.

In order to mitigate growth risks in 2025, Mr. Hung suggested Vietnam focus on stimulating domestic demand by increasing public spending on infrastructure, technology, and innovation. This approach would not only enhance the competitiveness of domestic enterprises but also strengthen Vietnam’s appeal to foreign investors.

ADB’s experts also recommended that Vietnam continue to enhance its value-added role in global supply chains to reduce economic risks. “Global supply chains involving FDI enterprises in Vietnam will form an important foundation for the country to diversify its export markets amid shrinking international demand,” Mr. Chakraborty remarked.

Furthermore, ADB experts acknowledged that the Vietnamese government has undertaken comprehensive institutional reforms to improve governance efficiency and promote economic growth. If these reforms are implemented more comprehensively, they will further support the development of the private sector, strengthen macroeconomic stability, and foster more sustainable growth for Vietnam in the medium to long term.

Google translate

Google translate