The Asian Development Bank (ADB) released its Asian Development Outlook (ADO) September 2025 on September 30.

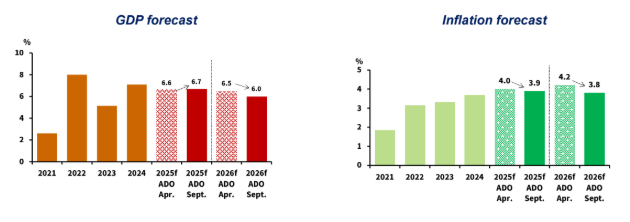

According to the report, ADB revised Vietnam’s 2025 economic growth forecast up to 6.7 per cent from 6.6 per cent forecast in the April, while lowering the 2026 growth projection to 6.0 per cent from 6.5 per cent in April.

ADB experts noted that despite significant global headwinds, Vietnam’s economy posted impressive results in the first half of 2025, with GDP growing 7.5 per cent, marking the strongest first-half performance since 2010.

Riding on this momentum, Vietnam’s industrial output is forecast to expand by 7.7 per cent in 2025, driven by stronger manufactured exports.

ADB experts also highlighted that the disbursements of the foreign direct investment (FDI) reaching $15.4 billion in the first eight months of 2025 - the highest level for the same period in the past five years, provided crucial momentum for Vietnam’s industrial development.

Meanwhile, the services sector is projected to maintain solid growth of 7.4 per cent in 2025. Agriculture growth is expected to expand by 3.4 per cent this year.

Vietnam's inflation is forecast at 3.9 per cent in 2025, easing slightly to 3.8 per cent in 2026.

The country is currently stepping up fiscal and monetary stimulus measures to achieve the government’s 2025 growth target of 8.3 per cent–8.5 per cent, with an eye toward double-digit growth in the coming years.

However, experts cautioned that tariff-related headwinds will continue to put pressure on trade and FDI inflows. In which, the United States’ reciprocal tariffs on Vietnam (20 per cent on imports and 40 per cent on transshipped goods) could pose significant downside risks to near-term growth prospects.

In addition, the prolonged Russia–Ukraine conflict, instability in the Middle East, and slowing demand from key trading partners may constrain Vietnam’s growth.

Therefore, experts stressed the need for Vietnam to restructure its economy toward a more balanced growth model, with stronger domestic demand and more diversified export markets to cushion against future tariff shocks.

Given its favorable fiscal position, the government could support growth through targeted tax cuts, reducing compliance costs for businesses, and expanding social spending for low-income households. Public investment efficiency, in particular, remains critical for sustaining growth and easing infrastructure bottlenecks.

According to Mr. Shantanu Chakraborty, ADB Country Director for Vietnam, better coordination between fiscal execution and monetary policies will help Vietnam avoid overburdening monetary tools and preserve macro-financial stability.

He noted that in the long term, wide-ranging regulatory reforms must tackle structural challenges, like ensuring climate resilience, boosting private sector competitiveness, enhancing the efficiency of state-owned enterprises, tax modernization, and digital transformation. This is vital for a more balanced growth in Vietnam.

Moreover, Mr. Nguyen Ba Hung, Principal Country Economist at the ADB in Vietnam, added that domestic enterprises currently account for only about 25–30 per cent of total exports, while the FDI sector makes up over 70 per cent.

Therefore, Mr. Hung emphasized that Vietnam needs to further strengthen the development of the domestic private sector. In particular, advancing science and technology is essential for enhancing the competitiveness of Vietnamese businesses in the years ahead.

Google translate

Google translate