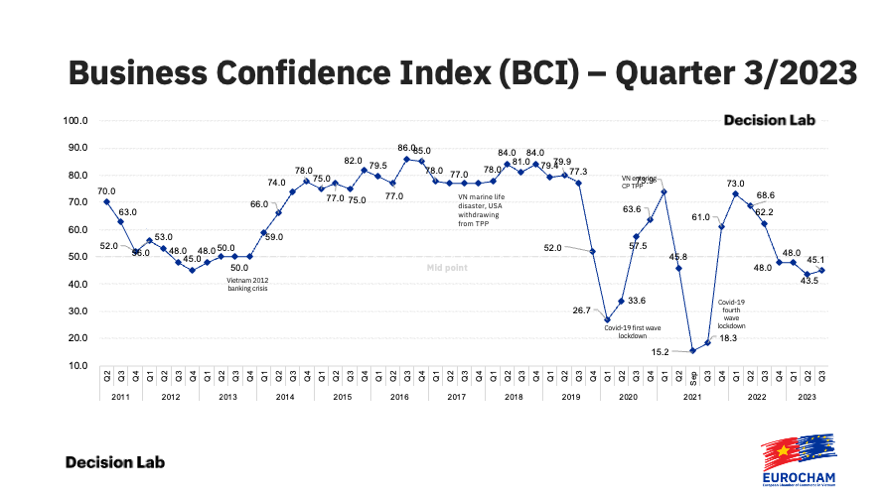

The European Chamber of Commerce Vietnam (EuroCham)’s quarterly Business Confidence Index (BCI) regained its upwards trajectory in the third quarter of 2023, offering a glimmer of hope for Vietnam’s business environment after a turbulent year. Conducted by Decision Lab, the BCI has provided a periodic pulse check on Vietnam’s economy since 2011.

It nudged up to 45.1 in the third quarter from 43.5 the previous quarter. While still below the 50-point threshold for four straight quarters, this small rise indicates emerging positive economic momentum.

Business sentiment appears to be in flux. Between the second and third quarters was a three percentage point decline in pessimism regarding the current situation, while positive and neutral perspectives increased by six and four percentage points, respectively.

The third-quarter survey also revealed a shift in projections for the quarter to come. Compared to responses in the second-quarter survey, there was an 11 percentage point rise in businesses anticipating economic stability and growth in the upcoming quarter. Businesses projecting a negative trend, meanwhile, fell five percentage points. “It is clear: Team Europe stands firmly behind Vietnam,” said Mr. Gabor Fluit, Chairman of EuroCham. “Nearly one-third of our members ranking Vietnam as a top 3 investment location sends a powerful message about our faith in this partnership.”

Similarly, Mr. Thue Quist Thomasen, CEO of Decision Lab, said that after weathering the challenges Vietnam now shows signs of recovery and resilience. “Retail and tourism have grown strongly, helping drive the economy forward,” he added. “Resumed FDI growth also offers optimism, reinforcing Vietnam’s status as a global business hub.”

He also noted that while exports and real estate continue to face hurdles, cautious optimism prevails. “This sentiment signals a possible turnaround in the country’s economic narrative,” he said. While the BCI still indicates slightly negative sentiment, it is positive to note the continued stability in the quarterly measurement. “Following a three-year period of high volatility, this new stability indicates that European business leaders can now predict the year ahead and better plan for future investments,” Mr. Thomasen added. “This is a positive development in itself.”

Approaching year-end, hope and caution persist. Though Vietnam’s third-quarter GDP grew a promising 5.3 per cent year-on-year, companies continue to be cautious. Expectations regarding increased revenue or orders remained stable, with no change from the previous quarter. Just 22 per cent of companies plan to expand their teams in the fourth quarter. Only 16 per cent expect an increase in investments.

In addition, Vietnam’s global investment appeal remains strong. A notable 63 per cent of surveyed businesses positioned it within their top 10 FDI destinations. Even more striking, 31 per cent ranked Vietnam among their top 3, while an impressive 16 per cent hailed it as their foremost investment destination. Reflecting this confidence, over half of those surveyed plan to increase their FDI in Vietnam by the end of the year.

However, Mr. Fluit noted that challenges remain. “While we saw promising third-quarter GDP and FDI growth, issues persist, especially with exports and real estate,” he said. “To progress, addressing administrative burdens, unclear regulations, and permitting hurdles is crucial. We remain committed to open dialogue to effectively tackle these issues together.”

Sustainability, meanwhile, is rising as a priority for European companies in Vietnam, with 80 per cent citing ESG alignment as highly or moderately important. “Seeing that 80 per cent of our members prioritize ESG alignment underscores a genuine commitment to responsible growth among businesses,” Mr. Fluit said. “By integrating green practices into business strategies, we pursue both development and progress.”

Google translate

Google translate