According to the Foreign Investment Agency (FIA) at the Ministry of Planning and Investment (MPI), additional FDI capital in May saw the largest increase year-to-date, surpassing $850 million. This represents a 2.8-fold increase against April, a 70 per cent rise against March, a 4.25-fold increase against February, and a more than 3.54-fold rise against January.

Though additional FDI recorded a significant surge in the first five months, it was still down year-on-year, by 8.7 per cent. The decline has gradually improved, however, with a 16.9 percentage point increase during the first four months of 2024, with 440 projects registering to add capital.

Major projects boosting investment

While it is premature to declare a full recovery in additional FDI capital, there has been a notable improvement compared to previous months. This highlights Vietnam’s continued appeal as an investment destination for foreign investors, owing to its economic growth prospects, sizeable market of 100 million people, and abundant workforce.

Encouraging trends are also being seen in newly-registered capital, with 1,227 projects receiving investment licenses in the first five months, a 27.5 per cent increase year-on-year. Total registered capital stood at nearly $7.94 billion, marking a 50.8 per cent increase. Disbursed FDI capital, meanwhile, continued its upwards trend, rising 7.8 per cent to approximately $8.25 billion.

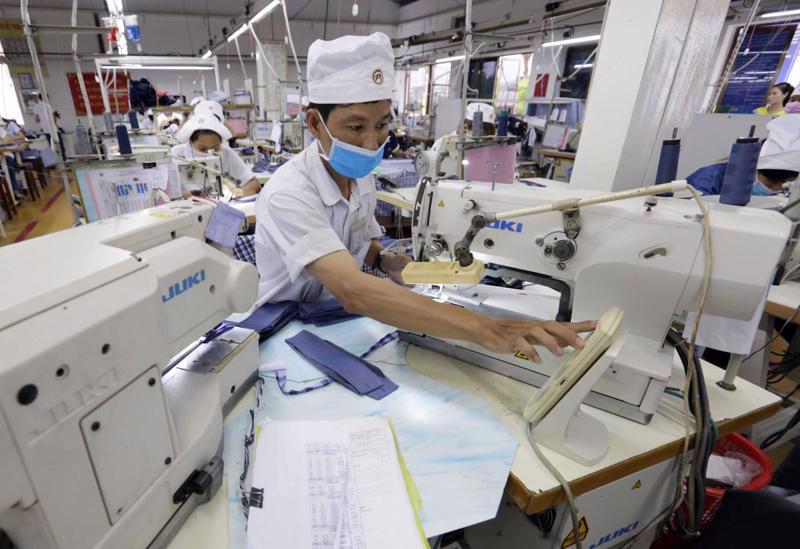

According to the FIA, many major projects in sectors such as energy (battery, photovoltaic cell, and silicon bar production), component manufacturing, and high value added electronic products received new and expanded investments during the first five months. This underscores that FDI is still flowing into high-quality industries and that investors are committing to long-term projects in Vietnam despite the ongoing economic challenges.

Mr. Nguyen Van Toan, Deputy Chairman of Vietnam’s Association of Foreign Invested Enterprises (VAFIE), said the country has maintained favorable conditions for attracting FDI. This has been particularly evident since the significant boost to diplomatic relations between Vietnam and the US, which has positively influenced FDI inflows from the country. Inflows from other countries, like the Netherlands and Germany, are also on the rise.

He also pointed out that Vietnam has significant opportunities to boost FDI attraction, similar to what occurred in 2008 after it joined the WTO. Its competitive edge in attracting FDI is driven by factors such as the race to control core technologies and chips. It is expected that, in 2024, more semiconductor companies from the US and partners from Japan, South Korea, and Taiwan (China) will come to Vietnam to explore opportunities and sign cooperative agreements.

Key cities and provinces gaining attention

Though the scale of FDI into Vietnam during the opening months of the year is promising, investment continues to be concentrated in cities and provinces boasting significant advantages in attracting FDI. These advantages include good infrastructure, stable workforce, efforts in administrative reform, and proactive investment promotions. Key regions include Hanoi, Ho Chi Minh City, northern Hai Phong city and Bac Ninh, Quang Ninh, Bac Giang, Thai Nguyen, and Hung Yen provinces, and southern Ba Ria-Vung Tau and Dong Nai provinces.

These ten localities accounted for 74.7 per cent of new projects in the first five months and 75.2 per cent of total investment. Ba Ria-Vung Tau led the way, with total registered investment capital exceeding $1.52 billion, representing 13.8 per cent of the country’s total and more than 12-times the amount in the same period last year.

At a conference hosted by the province on March 30 to launch its 2021-2030 development plan and facilitate investment, Mr. Nobuyuki Matsumoto, Chief Representative of the Japan External Trade Organization (JETRO) in Ho Chi Minh City, spoke of Ba Ria-Vung Tau as a prime investment destination. He noted its many advantages, including the Tan Cang - Cai Mep International Terminal, proximity to the under-construction Long Thanh International Airport in Dong Nai, abundant oil and gas resources, an LNG terminal, stable power supply, two universities, and its location adjacent to both Dong Nai and Binh Duong - two provinces with numerous factories supporting supply chains.

“One key aspect worth highlighting is the establishment of a one-stop-shop for Japan at the Ba Ria-Vung Tau Department of Planning and Investment, aimed at providing comprehensive assistance and addressing issues pertinent to Japanese enterprises,” he added. “I firmly believe that this constitutes a pivotal element for attracting investment to the province.”

Hanoi and Bac Ninh have also emerged as significant destinations for FDI among the 47 cities and provinces nationwide that attracted foreign capital in the opening five months of the year. Vietnam’s capital ranked second nationally, with investment nearing $1.14 billion, or 10.3 per cent of the total, which was actually a 39 per cent decline year-on-year. Bac Ninh was third, with $1.06 billion, or nearly 9.6 per cent of the national total. Ho Chi Minh City and Dong Nai and Quang Ninh provinces also played significant roles in the period.

Ho Chi Minh City took the lead in terms of new projects, with 37.8 per cent of the total, while also attracting 16.4 per cent of additional capital and 71.1 per cent of capital contributions or share acquisitions.

As of May 20, there were a total of 40,285 active projects around Vietnam, with registered capital nearing $481.33 billion. Foreign investors have invested in 19 of Vietnam’s 21 economic sectors. Manufacturing and processing has emerged as the frontrunner, accounting for nearly 60.4 per cent of total investment, amounting to $290.9 billion.

In terms of geographical distribution, the FIA reported that foreign investors have a presence in all of the country’s 63 cities and provinces. At the top is Ho Chi Minh City, with nearly $57.8 billion in FDI, or 12 per cent of the total, followed closely by Hanoi, with over $43.4 billion, or 9 per cent, and Binh Duong with more than $40.7 billion, or 8.5 per cent. These regions are also recognized for their top-notch infrastructure and amenities, making them appealing destinations in the eyes of foreign investors.

Furthering infrastructure

A recent JETRO survey highlighted the enhancements being seen in Vietnam’s infrastructure to increase its investment appeal. Its infrastructure competitiveness, however, still falls short of its regional counterparts. Hence, JETRO advises the prompt establishment of industrial park infrastructure in line with new and green trends, to bolster the country’s competitive edge in attracting quality FDI.

Minister of Planning and Investment Nguyen Chi Dung has said that the primary obstacle currently lies in mechanisms and policies related to green growth, particularly in green industrial parks, which remain incomplete and fragmented across various legal instruments. Consequently, MPI has announced plans to soon present national green taxonomy criteria to the government.

“In essence, this entails a system for categorizing which economic sectors qualify as green or otherwise,” the Minister said. “This will serve as a legal framework for localities and businesses to facilitate green development initiatives.”

Google translate

Google translate