Vietnam’s GDP growth of around 8.5 per cent this year - among the highest in Asia Pacific - combined with the expansion of its middle class has created a robust base of both international and domestic travelers. That was one of the reasons Hilton made a decisive move in Vietnam in October when it announced multiple property agreements with longstanding partner the Sun Group, one of the country’s most influential developers across recreation and entertainment, leisure travel, real estate, infrastructure, and aviation.

The partnership will introduce Hilton’s award-winning luxury brands, including Conrad Hotels & Resorts, LXR Hotels & Resorts, and DoubleTree by Hilton, to new destinations around Vietnam, while expanding the footprint of its flagship Hilton Hotels & Resorts brand. With nearly 1,800 rooms and five new hotels, the agreement will bring new international brands into the market and effectively double Hilton’s presence in Vietnam over the years to come.

Ms. Ms. Maria Ariizumi, Vice President of Development for Southeast Asia at Hilton, told Vietnam Economic Times / VnEconomy that “Vietnam has become one of the most important markets in Southeast Asia,” a rare destination that simultaneously meets three essential criteria: strong economic growth, rising tourism demand, and rapidly-improving infrastructure. “To build sustainable tourism, there must be a balance between international visitors and domestic spending power,” she explained. “Vietnam meets this requirement exceptionally well.”

Hospitality ascending

Vietnam’s return as one of Asia’s strongest tourism performers has created powerful tailwinds for hotel operators and investors. According to JLL’s Vietnam Hotel Investment Guide 2025, in the first eight months of the year, total hotel inventory exceeded 185,000 rooms, reflecting steady development momentum over the past decade. The report noted that from 2020 to 2024, nationwide RevPAR (Revenue Per Available Room) grew nearly 21 per cent each year, primarily due to rising occupancy. This recovery then accelerated in 2025.

Mr. Karan Khanijou, Senior Vice President, Asia Hotels & Hospitality Investment Sales, at JLL, underscored just how dramatic the turnaround has been. “Vietnam’s hotel market has demonstrated remarkable resilience and recovery momentum throughout 2025, positioning itself as one of Asia’s standout performers,” he told Vietnam Economic Times / VnEconomy.

Between January and November, 19.1 million international tourists visited Vietnam, a 20.9 per cent increase from the same period last year. Domestic travel soared to 130.6 million trips, up 36.6 per cent year-on-year.

The surge in demand has driven exceptional operating results. “Occupancy rates climbed approximately 14 per cent year-on-year, the strongest growth in the region, while average daily rates increased 5 per cent,” Mr. Khanijou noted. This combination delivered the strongest RevPAR growth in Asia-Pacific, reversing the challenges of 2023 and 2024.

From Hilton’s vantage point, these trends are visible on the ground. Ms. Ariizumi observed that occupancy in major cities stands at about 78 per cent, reflecting a recovery that is “among the strongest in the region.” Visa relaxation measures and major upgrades to airports, highways, and urban mobility networks have significantly improved accessibility, further reinforcing demand.

Beyond traditional leisure and business travel, Vietnam is also becoming an increasingly competitive destination for MICE (Meetings, Incentives, Conferences, and Exhibitions) events. “The government is making major investments in infrastructure and connectivity, improving access to key destinations,” Ms. Ariizumi said. Markets such as Quang Ninh, Da Nang, and Phu Quoc Island are gaining traction for regional conferences and international gatherings.

Race for assets

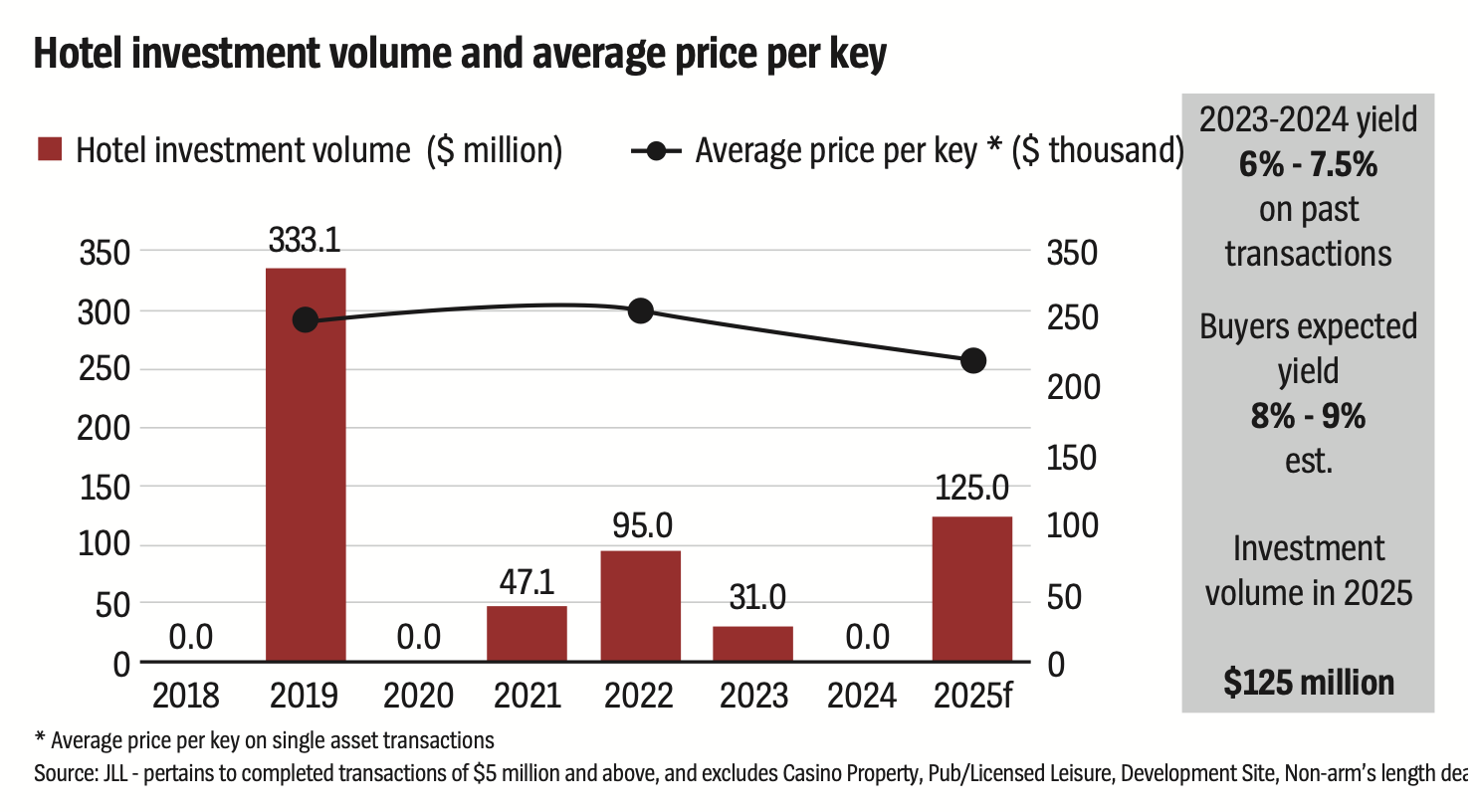

With performance rebounding, capital has returned. JLL has revised its hotel transaction forecast for 2025 upwards from $100 million to $125 million, reflecting stronger investor sentiment and confirmed deal flows. “The balance of 2025 appears favorable for continued transaction momentum,” Mr. Khanijou explained, supported by improved debt availability and healthier operating fundamentals.

Looking ahead, he expects this trend to continue. “Vietnam is well-positioned to capture increasing investor interest,” he said, forecasting $200 million in hotel transactions in 2026, provided more institutional-grade assets enter the market.

The appeal differs by investor group. Foreign buyers are looking at well-established assets in key destinations with long remaining lease terms, whilst domestic capital is coming back strongly, demonstrating increased appetite for acquisitions across both city center and resort assets.

But despite the rising demand, supply remains a critical bottleneck. The JLL report noted that while resort markets continue to expand, major cities such as Ho Chi Minh City and Hanoi face severe land constraints. Urban sites are tightly held, and competition from the residential sector is intensifying as Vietnam’s housing demand grows.

Ms. Ariizumi emphasized that developing hotels in emerging destinations requires more than land, it requires a complete tourism ecosystem. This thinking underpins Hilton’s long-term strategy. The company’s partnership with the Sun Group, timed ahead of the APEC 2027 Summit, is not merely leveraging a single event. “We are not interested in chasing a short-term event effect,” Ms. Ariizumi explained. Instead, the focus is on building balanced developments where accommodation and entertainment grow together to ensure sustainable destination appeal after 2027.

Elevating the experience

Vietnam’s tourism market is evolving towards higher-value travelers who seek authenticity, local identity, and international-standard service. This shift is redefining how global hotel brands operate in the country.

“The days when global hotels looked identical everywhere have passed,” Ms. Ariizumi said. Today’s guests want local character while still expecting world-class service. Hilton’s collaboration with the Sun Group reflects this approach, blending local cultural insight with international experience to create properties tailored to Vietnamese travelers and global visitors alike.

Another defining factor in Vietnam’s future is talent. “Vietnam has a young, dynamic workforce,” she noted, adding that international-standard training is key to meeting rising expectations. Hilton Garden Inn Da Nang’s partnership with Streets International, providing professional hospitality training for disadvantaged youth, is one example of how global brands are helping strengthen the industry’s talent pipeline.

Sustainability is also becoming integral to hotel development and operations. At La Festa Phu Quoc, Curio Collection by Hilton, sustainability measures include eliminating single-use plastics by adopting glass-bottled water produced on-site, and offering reusable woven bags and hats to guests. By integrating these practices “from project development to daily operations,” Ms. Ariizumi said, hotels can operate responsibly while enhancing guest experience.

For investors considering Vietnam, JLL offered several clear recommendations. Mr. Khanijou advised focusing on established urban markets and leading resort destinations, selecting assets with long remaining lease terms and strong strategic positions. Investors should also align their approach, whether core, value add, or development, with their risk appetite and long-term objectives. “The primary challenge remains unlocking institutional-grade assets,” he noted, but Vietnam’s strong fundamentals provide significant upside for those who can secure the right opportunities.

![[Interactive]: Economic overview - Q4/2025](https://premedia.vneconomy.vn/files/uploads/2026/01/06/29254292bae3426d91b9af031f679ce6-61851.png?w=400&h=225&mode=crop)

Google translate

Google translate