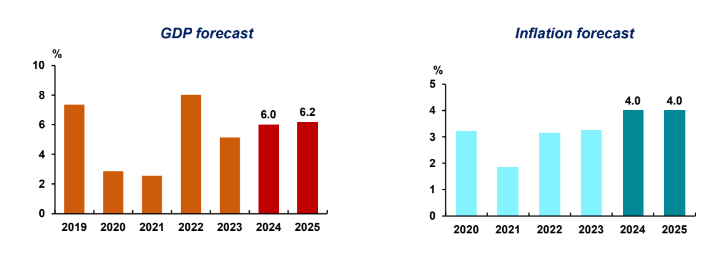

At a conference to announce updates on Vietnam’s economic development situation on September 25, the Asian Development Bank (ADB) projected that Vietnam’s economic growth (GDP) will reach 6 per cent in 2024 and continue to improve to 6.2 per cent next year.

According to the bank, Vietnam’s export-oriented industrial sector remains the main driver of growth, industrial sector is expected to grow by 7.3 per cent in 2024 and reach 7.5 per cent in the following year. The construction sector is also expected to continue growing if major infrastructure projects are implemented on schedule.

Regarding foreign direct investment (FDI) in Vietnam, in the first eight months of 2024, the registered capital reached $20.5 billion, an increase of 7 per cent compared to the same period last year. Notably, 77 per cent of the total FDI capital (equivalent to $13.6 billion) was invested in export-oriented manufacturing sectors, contributing to the growth of exports. Looking ahead, ADB forecasts that FDI will continue to increase in Vietnam and strongly support exports.

“Vietnam’s economy showed robust recovery in the first half of 2024 and continues to maintain momentum despite global uncertainties,” Mr. Shantanu Chakraborty, ADB’s Country Director for Vietnam, said. “This steady recovery has been driven by improving industrial production and a strong rebound in trade.”

Regarding inflation, ADB forecasts a slight increase of around 4 per cent for both 2024 and 2025. However, ADB experts also warn of risks from geopolitical tensions, including conflicts in the Middle East and between Russia and Ukraine, which could affect oil prices and increase inflationary pressures.

In addition to positive signs, Mr. Nguyen Ba Hung, ADB’s Principle Country Economist, pointed out several risks that could slow Vietnam’s growth. In which, demand from major economies remains weak, while geopolitical tensions and uncertainties related to the U.S. elections in November could disrupt trade, negatively impacting exports, production, and employment in Vietnam.

Despite achieving favorable results recently, Vietnam’s exports still face intense competition due to shifts in global trade and value chain restructuring, particularly in sectors like textiles and electronics. Moreover, risks from geopolitical tensions and rising protectionism also pose significant challenges to Vietnam’s economy.

In order to maintain growth momentum in the upcoming period, Vietnam needs to ensure macroeconomic stability with a harmonious combination of fiscal and monetary policies. “Strengthening domestic demand requires stronger fiscal stimulus measures, such as accelerating public investment disbursement, while maintaining low interest rates. Coordination between fiscal and monetary policies is essential for economic recovery, given relatively stable prices and weak domestic demand,” Mr. Hung noted.

Additionally, the state budget is expected to have a slight deficit by the end of 2024, as the National Assembly has approved a continued 2 per cent reduction in value-added tax (VAT) until the end of this year. However, budget spending implementation remains slow, therefore, ADB experts suggested that fiscal stimulus measures need to be prioritized in Vietnam.

Vietnam should also accelerate the disbursement of public investment capital to directly support sectors such as construction and manufacturing, thereby creating more jobs and driving economic growth in the near future.

Google translate

Google translate