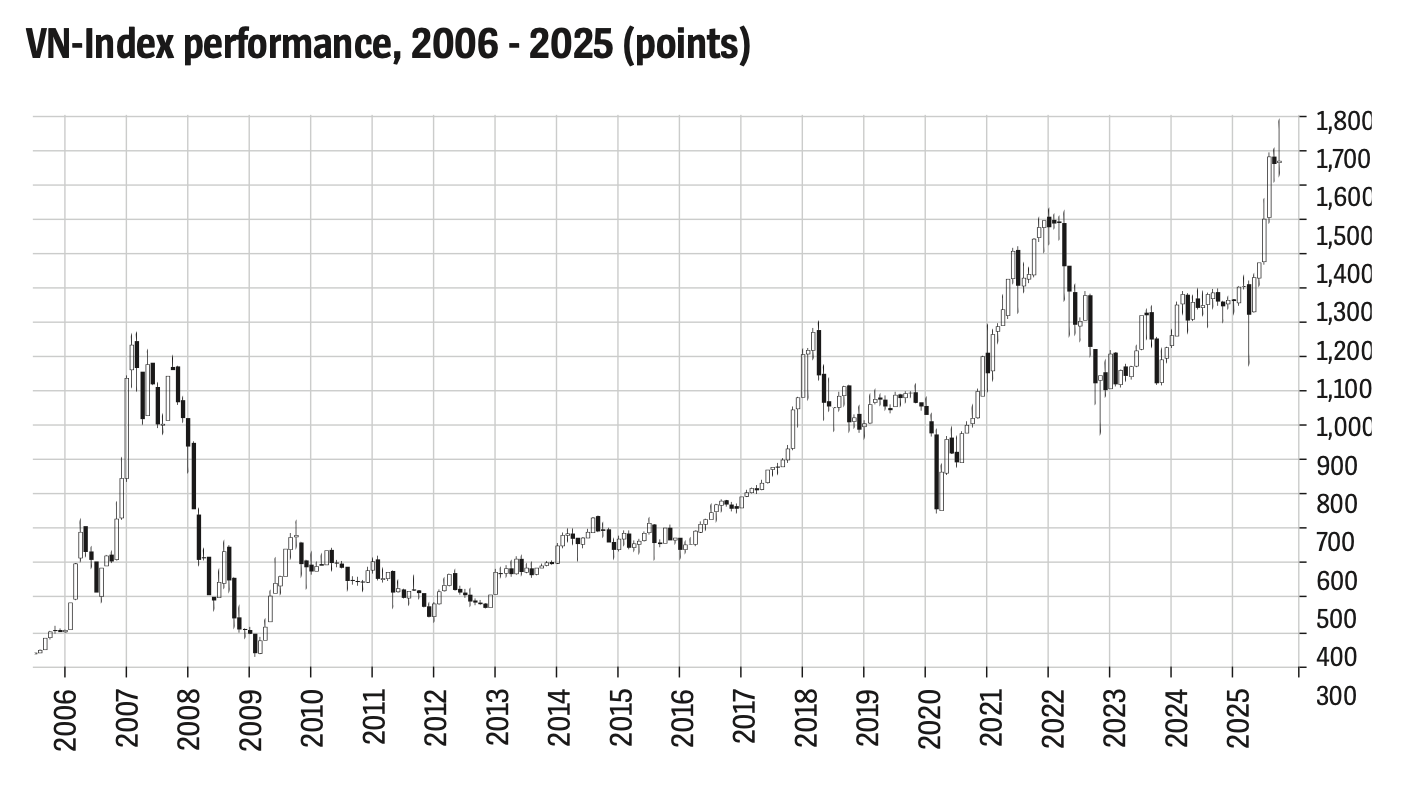

Vietnam’s stock market has been witnessing one of its most glorious moments in its 25-year history, with the VN-Index continually setting new records. The market is now entering a historic growth phase, driven by strong economic fundamentals, corporate resilience, and the prospect of an official upgrade to Emerging Market status.

25-year milestone

Alongside policy measures aimed at supporting growth, Vietnam’s stock market is entering its most remarkable growth cycle since 2020-2022. This time, however, the rally is built on more realistic expectations and qualitative improvements in fundamentals, both from the internal strength of listed companies and the overall economy as well as the opportunity to secure a place among emerging markets.

In October, the Index surpassed its previous all-time high of 1,700 points and is now on track to challenge the 1,800-point mark.

The macro-economic backdrop supports this long-term growth trend, as corporate business performance remains extremely positive. Vietnam’s GDP grew by an impressive 8.23 per cent in the third quarter of 2025; second only in the 2011-2025 period to the record 9.44 per cent growth posted in the same period of 2022 (the post-Covid recovery peak).

On October 8, FTSE Russell officially announced the upgrade of Vietnam’s stock market from “Frontier” to “Secondary Emerging” status, which is expected to take effect on September 21, 2026, pending review results next March. While some improvements are still needed, such as better access for international brokers, the announcement marks the clearest and most concrete progress yet in Vietnam’s market reclassification journey. FTSE confirmed that Vietnam has now met all criteria required for Secondary Emerging Market status.

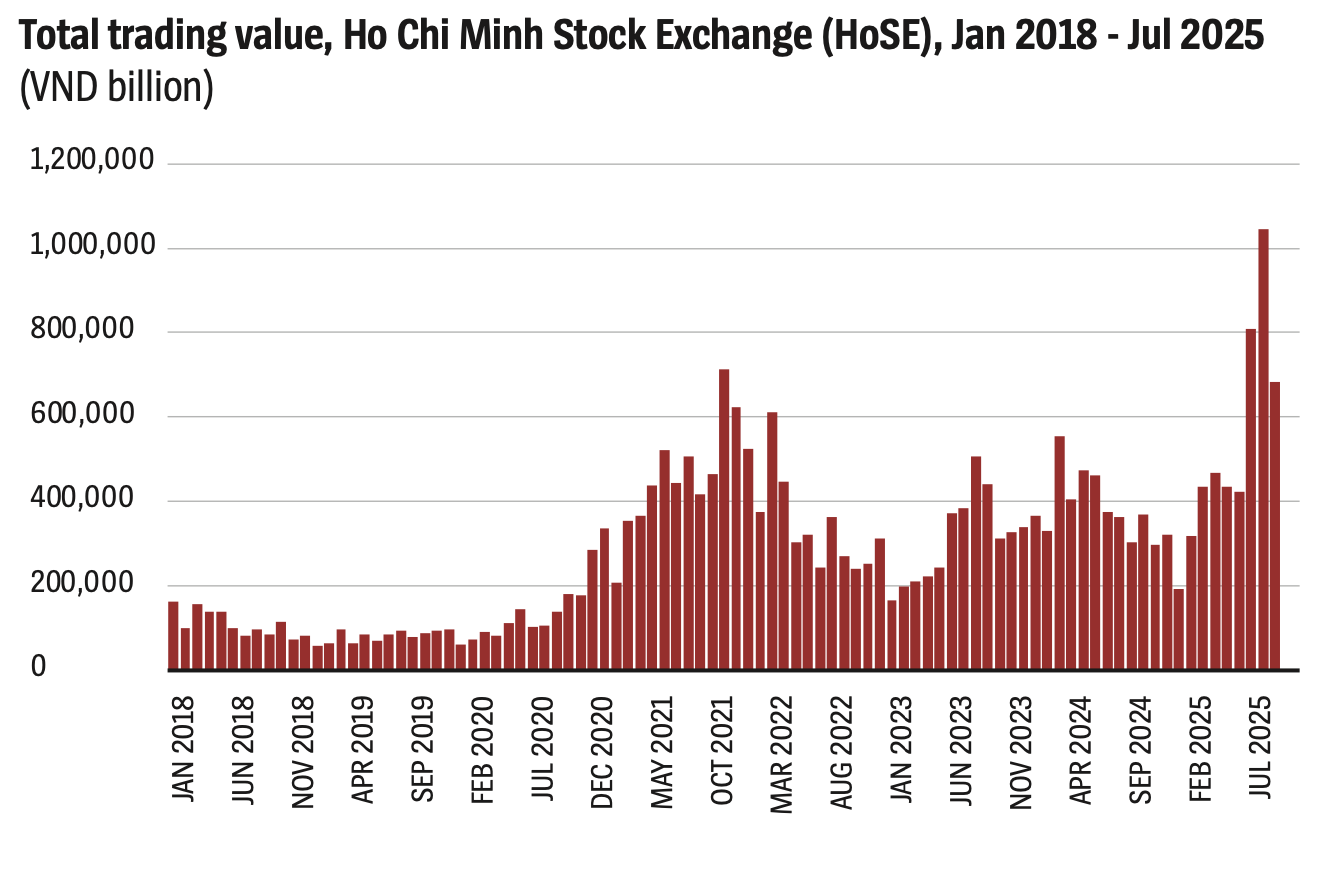

At the same time, trading volumes have reached unprecedented levels. During the first quarter of 2022, total daily transactions across its three exchanges surprised the market by hitting VND40-42 trillion ($1.54-$1.62 billion). In July and August 2025, meanwhile, sessions exceeding VND80 trillion ($3.08 billion) were recorded. The Ho Chi Minh Stock Exchange (HoSE) set a record in August, with total trading value surpassing VND1,000 trillion ($38.46 billion).

Trading sessions involving billions of US dollars have now become routine, underscoring the market’s growing appeal and the unprecedented concentration of investment flows. This explosive momentum reflects strong investor confidence as the economy is being stimulated towards a growth target above 8 per cent, backed by decisive policy measures.

Third-quarter 2025 data shows that the Index of Industrial Production (IIP) rose 10 per cent year-on-year, with the manufacturing and processing sector up 10.2 per cent. The Purchasing Managers’ Index (PMI), meanwhile, recovered to 52.4 points in July, driven by stronger output and new orders, and remained above the 50-point threshold in the following two months. Total retail sales of goods and consumer services rose by an estimated 10.1 per cent year-on-year in the third quarter.

In the first nine months of the year, total registered FDI stood at $28.54 billion, up 15.2 per cent, while disbursed FDI reached $18.8 billion, up 8.5 per cent and the highest level for any nine-month period between 2021 and 2025. These figures reaffirm foreign investors’ strong confidence in Vietnam’s business environment and reinforce expectations of another impressive year of growth in 2025.

Additionally, the after-tax profit of listed companies on HoSE grew 33 per cent year-on-year in the second quarter of 2025. With solid macro-economic drivers and robust corporate earnings prospects, investor optimism continues to rise, drawing fresh capital inflows into the market.

Figures show that 290,026 new securities accounts were opened in September, including 289,653 by domestic individual investors - the highest in 13 months. As of the end of September, the total number of accounts had reached 11.04 million, including 10.98 million domestic individual investors. This milestone fulfills one of the long-term development targets for Vietnam’s stock market by 2030.

With policy orientation and strengthening fundamentals, Vietnam’s stock market is now entering its most impressive expansion cycle in years, one grounded in real economic momentum, resilient corporate performance, and the prospect of joining the ranks of global emerging markets.

Future opportunities

Alongside the positive economic signals of 2025, one of the key drivers attracting investors to Vietnam’s stock market is the prospect of an official market reclassification.

According to forecasts, if Vietnam’s stock market is upgraded to Emerging Market status, it could attract at least $1 billion in passive capital from exchange-traded funds (ETFs), while inflows from active funds could be several times larger.

The stock market has previously captured global attention, particularly in 2007-2008, when the country became a member of the WTO, with the VN-Index tripling in value. Back in 2007, however, HoSE listed only about 140 companies, and the market faced a severe imbalance between liquidity and available stocks, with limited investment options.

Over the past decade, Vietnam’s stock market liquidity has improved significantly thanks to the rise of professional investment funds. As of the end of 2024, the number of open-ended funds in Vietnam had tripled compared to 2016, while the number of ETFs had increased eight-fold.

Despite this notable growth in market liquidity, the quantity and quality of listed companies have not improved at a comparable pace.

As of June 2025, the total number of listed firms on HoSE and the Hanoi Stock Exchange (HNX) was fewer than 700, and this figure has actually declined over the past five years as several companies were delisted or moved to the Unlisted Public Company Market (UPCoM).

Welcoming larger and more sophisticated investors requires not only infrastructure that meets international standards, from trading systems to investment products, but also a diverse selection of high-quality listed companies. These are the fundamental conditions for retaining foreign capital and continuing to attract new inflows.

Data from securities firms show that the number of Vietnamese stocks eligible for inclusion in FTSE-compliant investment portfolios remains limited. To qualify, companies must meet several criteria, such as a minimum free-float market capitalization of $150 million and a foreign ownership limit of at least a 20 per cent. Under current conditions, only about 15-20 of the more than 700 listed companies meet these requirements.

This reality underscores that Vietnam’s stock market faces a long-term challenge as it aspires to achieve higher classification standards, such as those of Morgan Stanley Capital International (MSCI).

Google translate

Google translate