Savills Ho Chi Minh City recently published its Q3 2023 market report, which highlighted a decline in retail stock. The available floor area for retail rental costs approximately VND1.5 million ($61.04) per sq m, a decline attributed to the conversion of some retail projects into office space or their outright sale.

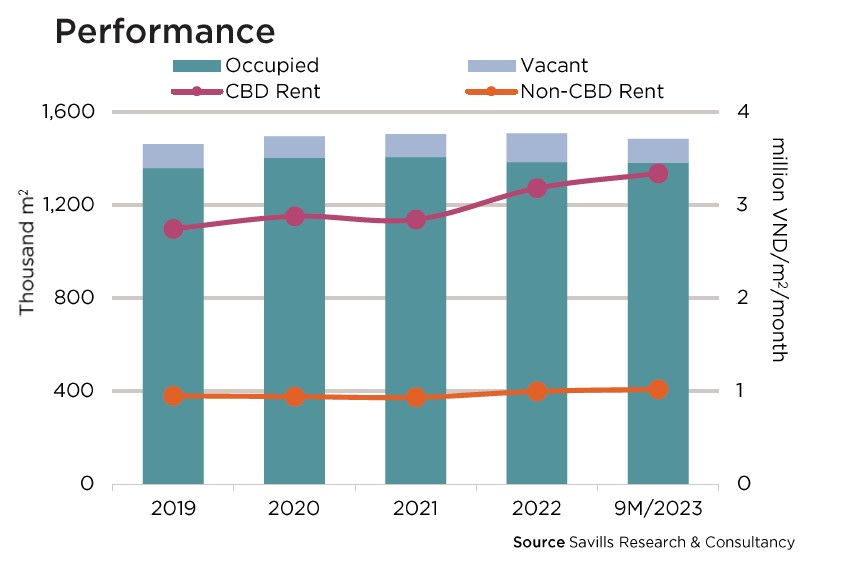

Despite a slight reduction in stock, occupancy has remained steady and high at around 91 per cent. However, rental prices have fluctuated. In non-CBD areas, rents saw a quarterly increase of 1 per cent, reaching VND1 million ($40.69) per sq per month. Rents trended upwards as Pandora City and Cantavil Premier, which previously offered more affordable rental rates, withdrew from the market. Conversely, central areas of the city have managed to maintain high rental prices, with rates soaring up to VND3.3 million ($134.3) per sq m per month.

Savills’ Q3 2023 report noted that middle-class demand is driving the market. It also highlighted that the food and beverages (F&B), fashion, health and beauty, and entertainment sectors saw the most new lease transactions. Significant demand for dining, shopping, and entertainment activities by the middle class is supporting the expansion of these sectors.

The outlook for 2024 includes the introduction of new supply from four projects, with some planning renovations and changes to their tenant structure to revitalize the retail cycle.

Ms. Cao Thi Thanh Huong, Senior Manager of the Research Department at Savills Ho Chi Minh City, expressed optimism about Vietnam’s economic growth, which is encouraging new brands to expand their presence in non-central areas.

Ms. Giang Huynh, Associate Director of Research & S22M Services, emphasized the unique characteristic of the southern city’s market: the substantial price disparity between central and non-central areas. “Rental prices in central areas consistently remain high due to limited stock, which accounts for less than 10 per cent of total market stock,” she said. “Simultaneously, brands and businesses have high demand for space in the city center. This has emboldened landlords of CBD projects to maintain high rental rates and occupancy levels.”

Google translate

Google translate